Table of Contents

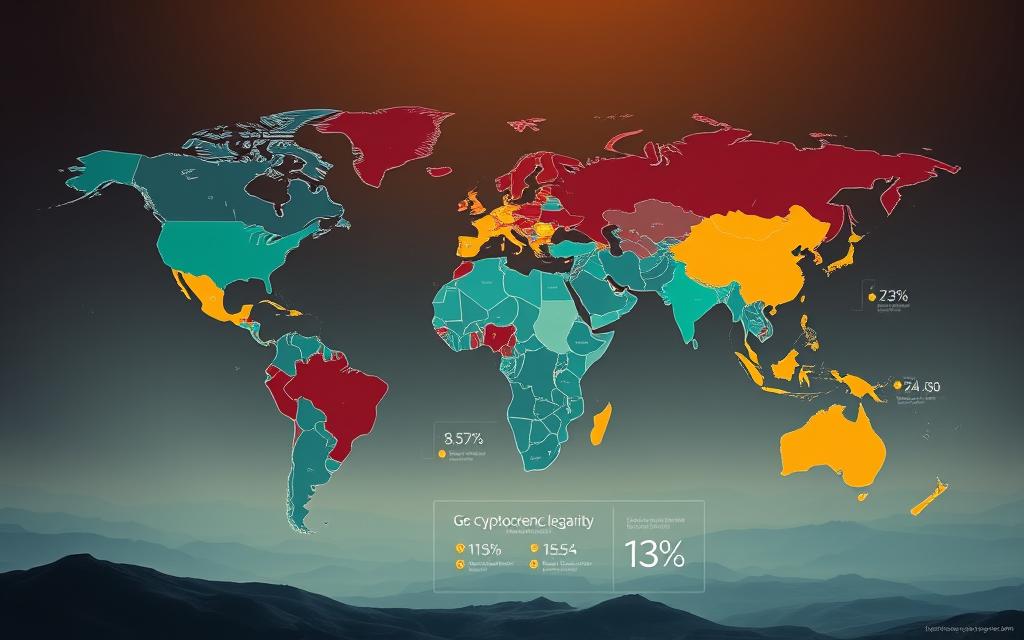

Digital assets face different legal treatments across the globe. While many nations allow their use, rules vary widely. Some classify them as commodities, while others treat them as financial instruments.

Governments approach regulations in unique ways. Developed countries often permit transactions but enforce strict oversight. Emerging markets show more diverse stances, from full acceptance to outright bans.

Understanding local laws remains crucial. Whether for trading, mining, or taxes, compliance matters. This guide explores how regions handle digital finance in 2024.

Key Takeaways:

- Legality depends on jurisdiction

- Classification differs (asset vs. currency)

- Regulatory frameworks continue evolving

Introduction to Cryptocurrency Legality

Nations worldwide adopt distinct stances on digital asset governance. These differences stem from economic priorities, regulatory philosophies, and technological infrastructure. No universal standard exists, creating a patchwork of rules.

What Determines the Legality of Cryptocurrency?

Three factors shape digital asset regulations: anti-money laundering (AML) compliance, tax treatment, and consumer safeguards. The U.S. IRS labels them as property, while the EU exempts bitcoin from VAT. Such classifications impact trading and reporting.

Monetary sovereignty concerns also drive policy. Countries with unstable currencies often impose stricter controls. Mature financial institutions enable nuanced oversight, whereas emerging markets may ban assets outright.

Why Cryptocurrency Regulations Vary Globally

Intergovernmental bodies like FATF provide guidelines, but enforcement remains national. The EU’s VAT exemption contrasts sharply with U.S. capital gains rules. This disparity reflects deeper debates about blockchain’s role in economies.

Technological readiness plays a part. Japan licenses exchanges, while Algeria prohibits all transactions. Such extremes highlight the lack of a cohesive framework. Users must navigate these variations carefully.

Is Cryptocurrency Illegal? Key Global Perspectives

Jurisdictions classify blockchain-based assets under five distinct regulatory tiers. These range from full acceptance as legal tender to complete prohibitions. Understanding these categories helps users navigate cross-border transactions.

Legal Tender vs. Permissive vs. Restricted Status

El Salvador made history in 2021 by adopting bitcoin as legal tender. Despite initial enthusiasm, challenges like technical glitches and low adoption persist. The Central African Republic followed briefly before repealing its law.

Other countries take a middle path:

- Japan: Licenses exchanges but bans privacy coins

- UAE: Issues progressive licenses for trading platforms

- China: Banned mining in 2021 but allows Hong Kong to pilot regulated exchanges

Nations with Contentious or Prohibited Laws

Algeria and Egypt enforce blanket bans, with banks barred from processing crypto transactions. Meanwhile, Nigeria thrives with peer-to-peer trading despite regulatory warnings.

Recent shifts show volatility:

- Bolivia lifted its 2014 restrictions in 2023

- Saudi Arabia continues its banking prohibition

- India maintains ambiguous tax policies

These disparities underscore the lack of global consensus. Users must verify local rules before transacting.

Cryptocurrency Legality in the United States

The U.S. maintains a complex regulatory landscape for digital assets. Federal agencies and state governments enforce distinct rules, creating a patchwork of compliance requirements. Understanding these layers helps users navigate legal risks.

Federal and State-Level Regulations

At the federal level, the SEC and CFTC share oversight. The SEC treats some tokens as securities, while the CFTC regulates derivatives. This overlap often confuses businesses and investors.

States add another layer of complexity:

- Texas offers tax incentives for mining operations.

- New York requires the costly BitLicense for exchanges.

- Wyoming grants digital assets the same status as traditional property.

| State | Key Regulation | Impact |

|---|---|---|

| California | Strict AML compliance | Higher costs for exchanges |

| Florida | No state income tax on crypto | Attracts traders |

| Washington | Banned unlicensed exchanges | Reduced market access |

IRS Treatment of Cryptocurrency

The IRS classifies digital assets as property under Notice 2014-21. This means every trade or purchase triggers a taxable event. Since 2020, Form 1040 includes a mandatory crypto question.

Key reporting requirements for 2024:

- Capital gains apply to holdings sold after one year.

- Income tax rates affect mined or staked coins.

- Failing to report may trigger audits or penalties.

FinCEN’s 2018 guidance also targets mixing services. Unregistered exchanges face enforcement actions, as seen in recent SEC lawsuits. Compliance remains critical for legal operations.

How the European Union Regulates Cryptocurrency

Europe’s evolving framework for digital assets balances growth and risk. The EU blends innovation with strict oversight, shaping a model other regions watch closely. Policies span tax rules, energy debates, and unified licensing.

VAT and Tax Implications

A 2015 EU court ruling exempts fiat-to-crypto conversions from VAT. Goods bought with crypto, however, face standard sales taxes. Traders must track gains under national laws—Germany taxes after one year, while France imposes flat rates.

Key reporting thresholds vary:

- Italy: €2,000+ annual trades trigger declarations

- Spain: Requires forms for holdings exceeding €50,000

- Portugal: No capital gains tax if held over 365 days

European Central Bank’s Stance

The ECB labels bitcoin a convertible decentralized virtual currency. This classification avoids equating it with sovereign money but acknowledges its transactional role. MiCA, the bloc’s landmark regulation, will standardize rules for stablecoins by 2025.

National differences persist:

- Germany’s BaFin mandates licenses for custodial services

- France’s AMF enforces stricter ad disclosures

- Sweden pushes for a Proof-of-Work mining ban

Energy debates further complicate policies. The EU Parliament debated banning energy-intensive mining in 2022 but settled on disclosure rules instead. MiCA’s phased rollout aims to harmonize this patchwork by 2026.

Cryptocurrency in Asia: A Mixed Landscape

Asia presents a diverse regulatory patchwork for digital finance. Some nations embrace innovation, while others enforce strict controls. This divide reflects economic priorities and technological readiness.

China’s Restrictions and Recent Changes

China banned initial coin offerings (ICOs) in 2017, citing financial risks. Yet, in 2023, it licensed select exchanges under tightened oversight. The shift aligns with its digital yuan rollout, aiming to curb competition.

Hong Kong’s 2023 policy reversal allowed retail trading, contrasting mainland rules. Meanwhile, the PBOC restricts peer-to-peer transactions, pushing users toward state-backed alternatives.

Japan’s Progressive Cryptocurrency Laws

Japan’s Payment Services Act recognizes digital assets as legal property. The Financial Services Agency (FSA) mandates rigorous registration for exchanges. This framework balances growth with consumer protection.

Key features of Japan’s system:

- Strict anti-money laundering (AML) checks

- Ban on privacy coins like Monero

- Compensation schemes for hacking losses

| Country | Key Regulation | Impact |

|---|---|---|

| South Korea | Real-name bank accounts for trading | Reduces anonymous transactions |

| Singapore | MAS licensing for stablecoins | Attracts businesses |

| India | 30% tax on gains | Deters retail investors |

Cryptocurrency in Africa: Emerging Trends

Africa’s digital finance landscape shows sharp contrasts between progressive policies and strict prohibitions. While some countries embrace blockchain innovation, others maintain cautious approaches through financial institutions. This divergence creates unique opportunities and challenges across the continent.

Legal Status in Nigeria and South Africa

Nigeria leads Africa in peer-to-peer trading volume despite its Central Bank’s 2021 bank restrictions. The Securities and Exchange Commission (SEC) now recognizes digital assets as securities, creating a regulatory paradox. Platforms like BuyCoins thrive through alternative payment methods.

South Africa took a decisive step in 2022 by declaring crypto assets as financial products. The Financial Sector Conduct Authority framework requires licensing for activities involving digital currencies. This move legitimizes exchanges while imposing consumer protection measures.

Ban in Algeria and Egypt

Algeria’s 2018 financial law prohibits all use of virtual currencies, with penalties for offenders. Egyptian authorities cite Islamic finance principles in their ban, though enforcement remains inconsistent. Both nations block bank transactions related to digital assets.

Key regional developments include:

- Kenya’s exploration of blockchain bonds for infrastructure funding

- Tanzania’s pilot central bank digital currency (CBDC) project

- Morocco’s warning system for unauthorized trading platforms

Energy-rich nations like Congo show potential for mining operations. However, power grid limitations and regulatory uncertainty hinder large-scale adoption. The continent’s payment system integration faces technical and legal barriers that slow cross-border transactions.

Latin America’s Approach to Cryptocurrency

From legal tender to banking bans, Latin America showcases extreme regulatory contrasts. Remittance markets and inflation drive adoption, while governments wrestle with financial stability concerns. The region offers a real-time laboratory for digital asset policies.

El Salvador’s Groundbreaking Experiment

In 2021, El Salvador became the first nation to adopt bitcoin as legal tender. The Chivo wallet system offered $30 incentives, though technical issues hampered rollout. Despite low merchant adoption, remittances now account for 23% of GDP via crypto channels.

Key challenges persist:

- Volatility deters everyday purchases

- Dollar remains dominant for wages

- IMF repeatedly warns about fiscal risks

Contrasting Policies in Neighboring Nations

Argentina’s central bank banned institutional crypto transactions in 2022 amid peso instability. Citizens still trade peer-to-peer, with monthly volumes exceeding $1 billion. Brazil took the opposite approach, legalizing crypto payments in 2023 through licensed providers.

| Country | Policy | Economic Impact |

|---|---|---|

| Venezuela | Petro coin failed, mining restricted | Informal dollarization continues |

| Colombia | Regulatory sandbox since 2021 | Increased fintech investment |

| Paraguay | Mining debates over energy use | Attracts Chinese mining firms |

“Latin America’s crypto adoption stems from necessity, not luxury – when traditional systems fail, people innovate.”

Central bank digital currencies (CBDCs) gain traction as governments seek controlled alternatives. Brazil’s Drex and Mexico’s peso digital aim to modernize payments while maintaining monetary sovereignty. These developments create complex competition for decentralized assets.

Middle Eastern Cryptocurrency Regulations

The Middle East presents a unique regulatory mosaic for digital finance. Gulf nations leverage their financial institutions to craft distinct approaches, blending Islamic finance principles with modern blockchain governance. This creates sharp contrasts between progressive hubs and restrictive monarchies.

UAE’s Progressive Licensing System

Dubai established the Virtual Asset Regulation Authority (VARA) in 2022, creating the region’s most detailed framework for digital assets. The Abu Dhabi Global Market (ADGM) complements this with comprehensive rules for exchanges and custodians.

Key features of the Emirates’ system:

- Seven license categories covering trading, lending, and management

- Strict anti-money laundering (AML) protocols for all platforms

- Tax-free zones attracting global crypto businesses

Saudi Arabia’s Conservative Stance

The Saudi Arabian Monetary Authority (SAMA) maintains a blanket prohibition on banks processing crypto transactions. A 2018 fatwa declared trading haram under Islamic law, though peer-to-peer activity persists informally.

Regional contrasts emerge clearly:

| Country | Policy | Market Impact |

|---|---|---|

| Bahrain | On-chain settlement trials | Attracts fintech startups |

| Israel | 25% capital gains tax | Reduces retail speculation |

| Turkey | Lira crisis driving adoption | Daily volumes exceed $1B |

“The Gulf’s crypto divide mirrors its economic strategies – Dubai builds for tomorrow, while Riyadh protects today’s systems.”

Cross-border AML cooperation through the Middle East and North Africa Financial Action Task Force (MENAFATF) adds another layer of complexity. This regional body pushes for unified standards despite national policy differences.

Cryptocurrency and Tax Obligations

Navigating tax obligations for virtual holdings requires understanding complex IRS guidelines. The U.S. treats digital assets as property, making every trade or sale a potential taxable event. Failure to comply can lead to audits or penalties.

How the IRS Classifies Digital Assets

Since 2014, the IRS has labeled crypto as property under Notice 2014-21. This means:

- Capital gains apply to profits from sales after one year.

- Mining rewards count as income at fair market value.

- NFTs are taxed based on use (collectibles vs. investments).

Form 1040 now includes Question 1, mandating disclosure of all transactions. The 2023 $10,000 rule also requires reporting large transfers.

Reporting Requirements for U.S. Taxpayers

Accurate record-keeping is critical. Key steps include:

- Calculating cost basis for each transaction.

- Reporting foreign holdings via FBAR/FATCA if exceeding $10,000.

- Documenting charitable donations of crypto at fair value.

“The IRS aggressively targets underreporting—even small errors can trigger audits.”

Audit red flags include mismatched 1099 forms and inconsistent reporting. Using crypto tax software helps streamline compliance.

Cryptocurrency and Anti-Money Laundering (AML) Laws

Financial authorities worldwide are tightening anti-money laundering controls for digital asset transactions. The Financial Action Task Force (FATF) leads global efforts with its updated framework for virtual asset service providers (VASPs).

Global AML Standards for Digital Assets

The FATF Travel Rule now requires identifying senders and receivers of $1,000+ transactions. Over 40 countries have implemented this regulation, including:

- Mandatory VASP registration in Singapore and Japan

- Chainalysis forensic tools adopted by Europol

- Delisting of privacy coins from major exchanges

Europe’s 6AMLD extends liability for laundering activities to senior management. The U.S. Treasury has sanctioned mixing services like Tornado Cash, setting precedent for enforcement.

U.S. Financial Crime Enforcement Network Rules

FinCEN’s 2020 thresholds require reporting $10,000+ crypto transfers. Institutions must file Currency Transaction Reports (CTRs) within 15 days. The rules apply to:

- Crypto exchanges operating in U.S. jurisdictions

- Banks processing digital asset transactions

- MSBs handling convertible virtual currencies

“The crypto industry’s compliance maturity now matches traditional finance—laggards face existential risks.”

Know Your Customer (KYC) protocols have become standard. Over 85% of exchanges now verify identities, compared to just 35% in 2017. This shift reflects growing alignment between digital and traditional finance systems.

The Role of Financial Institutions in Cryptocurrency

Traditional financial systems and digital assets increasingly intersect, creating complex regulatory challenges. Financial institutions act as gatekeepers, determining access to banking services for crypto businesses. This dynamic shapes global markets, from correspondent banking networks to custody solutions.

Banking Restrictions and Market Consequences

Canada’s 2018 banking limitations demonstrated how quickly policies can reshape assets liquidity. Major banks blocked transfers to crypto platforms, forcing traders toward riskier peer-to-peer channels. The 2023 Silvergate Bank collapse further highlighted systemic vulnerabilities.

Key challenges for institutional adoption:

- Correspondent banking: Many global financial institutions refuse crypto-related wire transfers

- Stablecoin reserves: Regulators demand 1:1 backing with frequent audits

- Custody insurance requirements exceeding $500 million for major platforms

Navigating Regulatory Frameworks as an Exchange

Leading exchanges employ dual strategies to comply with conflicting oversight. The SEC treats tokens as securities, while the CFTC regulates derivatives. This forces platforms to maintain separate licensing for different asset classes.

Recent legal precedents reshape operations:

- FTX’s bankruptcy established creditor hierarchies for digital holdings

- Celsius case set rules for interest-bearing accounts

- Travel Rule solutions now verify identities for $3,000+ transactions

“The most compliant exchanges will dominate next-generation finance—survivors invest over 20% of revenue in legal teams.”

Insurance products now cover hacking and internal fraud. However, premiums often exceed 5% of covered amounts, creating barriers for smaller exchanges.

Cryptocurrency Mining Laws Worldwide

Global mining regulation ranges from tax incentives to outright prohibitions. This divergence stems from environmental concerns, energy demands, and economic priorities. Governments balance technological innovation with grid stability and ESG commitments.

Legal Mining Hotspots

Texas emerged as a global leader after China’s 2021 ban. The state offers:

- Tax breaks for mining businesses using flared gas

- Deregulated power markets enabling flexible energy use

- Noise law exemptions for rural operations

Kazakhstan initially welcomed miners but faced power grid overloads. New rules now require:

- Licensing for all mining activities

- Priority access for renewable energy projects

- Strict ASIC import controls

Countries Banning Mining Activities

China’s comprehensive prohibition set a precedent in 2021. The policy:

- Shut down 90% of global hash rate overnight

- Cited financial risks and carbon emissions

- Pushed operations to Central Asia and North America

Other restrictive jurisdictions include:

| Country | Restriction Type | Effective Date |

|---|---|---|

| Algeria | Complete ban | 2018 |

| Egypt | Banking blockade | 2020 |

| Sweden | PoW phase-out | 2023 |

“Mining migration follows three paths: cheap energy, friendly regulation, or regulatory arbitrage opportunities.”

Emerging trends show increased focus on renewable energy solutions. Solar-powered farms in West Texas and hydro projects in Norway demonstrate sustainable alternatives. Proof-of-Stake networks gain regulatory advantages due to lower environmental impact.

Cryptocurrency and Consumer Protection

Market volatility and complex technology expose users to unique risks. Regulators prioritize safeguards as adoption grows. The FTC reported $1 billion in crypto scams during 2022 alone.

Risks of Unregulated Markets

Fraudulent schemes thrive where oversight is weak. Common threats include:

- Rug pulls: Developers abandon projects after fundraising

- Fake wallets draining digital assets

- Pump-and-dump groups manipulating prices

Protective measures are evolving:

| Risk Type | Prevention Method | Effectiveness |

|---|---|---|

| Exchange Hacks | Cold storage insurance | 85% coverage for top platforms |

| Smart Contract Bugs | Third-party audits | Reduces vulnerabilities by 72% |

| Phishing Attacks | Multi-factor authentication | Blocks 99% of unauthorized access |

How Governments Are Addressing Scams

The EU’s Digital Operational Resilience Act (DORA) mandates stress testing for exchanges. New legislation requires:

- 90-day fund withdrawal capabilities

- Mandatory disclosure of audit results

- Real-time transaction monitoring systems

“Education reduces victimization—we’re partnering with platforms to embed warning systems.”

Class action lawsuits against failed platforms set precedents. Over $3 billion was recovered for users in 2023 through legal actions. Regulatory sandboxes now test new protection tools before market rollout.

The Future of Cryptocurrency Regulation

Regulatory landscapes for digital assets continue evolving at breakneck speed. The Bank for International Settlements (BIS) reports 78 countries now developing central bank digital currencies (CBDCs). This rapid adoption creates both opportunities and fragmentation risks.

Emerging Global Standards

G20 nations agreed on a 2025 roadmap for cross-border payment regulation. Key focus areas include:

- Real-time transaction monitoring systems

- Standardized licensing for DeFi platforms

- Carbon disclosure mandates for mining operations

The IMF’s crypto risk matrix highlights jurisdictional arbitrage concerns. Smaller nations often adopt lighter rules to attract markets, creating regulatory loopholes.

Technological and Legal Convergence

Artificial intelligence now powers 43% of compliance tools at major exchanges. These systems track:

| Technology | Regulatory Application | Accuracy Rate |

|---|---|---|

| Machine Learning | AML pattern detection | 92% |

| Blockchain analytics | Tax reporting | 87% |

| Smart contracts | Automated KYC | 79% |

“A harmonized framework remains essential—no single jurisdiction can effectively regulate borderless technologies.”

Climate legislation adds another layer. The EU now requires energy source disclosures for all registered mining operations. Similar rules may expand to Asia and North America by 2026.

Key Takeaways on Cryptocurrency Legality

Global crypto adoption reveals striking contrasts in legal acceptance. The 2023 Chainalysis report highlights how countries approach digital assets differently. Understanding these variations helps users navigate risks and opportunities.

The Acceptance Spectrum

Five jurisdictions lead in crypto-friendliness:

- Switzerland: Recognizes legal tender status for select payments

- Singapore: Clear licensing for transactions and custody

- Portugal: Tax-free personal trading under specific conditions

- Germany: Banks can custody digital assets

- El Salvador: Full bitcoin adoption despite IMF criticism

Conversely, these nations impose strict prohibitions:

- China (mainland): Complete ban on trading and mining

- Egypt: Religious edict against digital currencies

- Qatar: Banking blockade on crypto-related transfers

Essential Considerations for Users

Cross-border travel requires careful planning. Over 30 nations mandate declarations for digital wallets exceeding $10,000 value. Japan and South Korea enforce the strictest reporting laws.

Inheritance planning presents unique challenges:

- Only 12% of nations have clear probate rules for digital assets

- Private key storage solutions remain legally ambiguous

- Multi-signature wallets gain traction for estate planning

“The most progressive jurisdictions combine consumer protection with innovation—this balance will define future adoption.”

Emerging markets show untapped potential. Nigeria’s peer-to-peer volume grew 9% in 2023 despite central bank restrictions. Brazil’s new payment rules create Latin American opportunities.

Conclusion

Global financial systems are adapting to digital asset innovations at varying speeds. Regulations will keep evolving, demanding robust compliance frameworks for safe participation.

By 2025, expect clearer global standards for transactions and custody. Users should prioritize platforms with transparent audits and legal certifications.

Stay informed through regulatory updates from trusted sources like the FATF or local agencies. Consult legal experts before major investments to navigate this dynamic landscape confidently.

The future of finance hinges on balancing innovation with protection—education and caution remain key to sustainable adoption.

FAQ

What determines the legality of digital assets?

Governments assess risks like fraud, tax evasion, and financial instability. Laws differ based on economic policies and security concerns.

Why do regulations vary across countries?

Nations balance innovation with financial safety. Some embrace blockchain tech, while others restrict it due to volatility or illicit use.

Where is Bitcoin recognized as legal tender?

El Salvador and the Central African Republic accept it as official currency. Most nations treat it as property or a commodity.

How does the U.S. regulate transactions involving digital currencies?

The IRS taxes them as property, while FinCEN enforces AML rules. States like New York require BitLicense for exchanges.

What’s the EU’s stance on virtual currencies?

Markets in Crypto-Assets (MiCA) framework standardizes rules. The ECB monitors risks but doesn’t ban trading or mining.

Which Asian nations have strict bans?

China prohibits exchanges and mining. India taxes gains at 30%, while Japan licenses platforms under strict oversight.

Are there banking restrictions in the Middle East?

Saudi Arabia bars banks from handling crypto. The UAE allows licensed exchanges in Dubai’s free zones.

What tax rules apply to holders of digital assets?

The U.S. requires reporting gains over 0. The EU imposes VAT on services but not currency trades.

How do AML laws affect exchanges?

Platforms must verify identities and report suspicious activity. Non-compliance risks penalties or shutdowns.

Which countries ban mining activities?

Algeria, Egypt, and Morocco prohibit mining due to energy concerns. Iceland and Canada welcome it with renewable energy.

What protections exist against scams?

The SEC pursues fraud cases, while the EU’s MiCA mandates transparency. Users should research platforms before investing.

Could global standards emerge?

The G20 and IMF discuss unified rules, but adoption remains slow due to differing national interests.