Table of Contents

Bitcoin made headlines in 2024, surging 120% to surpass $100,000 by year-end. This historic rally has investors questioning what lies ahead. With shifting political landscapes, many wonder how future policies could shape the market.

Institutional adoption continues to grow, with firms like Semler Scientific adding digital assets to their balance sheets. This trend signals confidence in crypto as a long-term investment. However, regulatory uncertainty remains a key concern for traders and companies alike.

Market analysts highlight potential policy shifts under new leadership. Some speculate that a pro-crypto stance could drive further gains. Yet, volatility persists, reminding investors to stay informed through thorough research.

For those exploring trading strategies, consider learning about trading cryptocurrency CFDs as an alternative approach. The market’s next moves depend on both economic factors and political developments.

Will Crypto Go Up When Trump Takes Office? Key Policies to Watch

Political shifts often bring market-moving changes, and the crypto industry is no exception. With potential policy adjustments on the horizon, investors are closely monitoring developments that could shape the future of digital assets.

Strategic Bitcoin Reserve: A Game-Changer?

One proposal gaining attention involves creating a national Bitcoin reserve. The plan suggests acquiring 200,000 BTC annually, valued at roughly $19 billion initially. This approach mirrors Senator Lummis’ bill advocating for federal digital asset holdings.

However, challenges exist. Legal constraints may limit the Federal Reserve’s ability to hold such assets. “Government accumulation of Bitcoin raises complex questions about market influence,” notes a recent NPR analysis.

Energy Focus and Domestic Mining Growth

The new administration’s “Made in USA” energy agenda could benefit bitcoin miners. This contrasts with previous regulatory hurdles, offering potential relief for domestic mining operations.

Key elements include:

- Streamlined permits for mining facilities

- Tax incentives for renewable energy use

- Clearer guidelines for mining operations

Regulatory Appointments and Framework Progress

Potential nominees like Paul Atkins (SEC) and David Sacks (AI/crypto czar) signal a shift toward industry-friendly regulation. Their backgrounds suggest faster ETF approvals and clearer legislation.

Bipartisan support is growing for comprehensive policy frameworks. This could accelerate institutional adoption while protecting consumer interests.

“The right balance between innovation and oversight will determine America’s position in the global digital economy.”

Market Reactions and 2025 Price Predictions

Investors witnessed significant price movements across major cryptocurrencies post-election. Bitcoin surged to $105,000 before correcting to $90,000, reflecting 30% volatility within weeks. This swing highlights the market’s sensitivity to political developments.

Post-Election Surge and Recent Corrections

The initial rally stemmed from optimism about potential policy changes. However, WisdomTree analysts warned about tariff risks impacting miner profitability. Historical data shows similar halving-cycle gains reached 539% in 2013.

Market corrections created buying opportunities for institutional players. Companies like MicroStrategy continued accumulating Bitcoin, signaling confidence in long-term value.

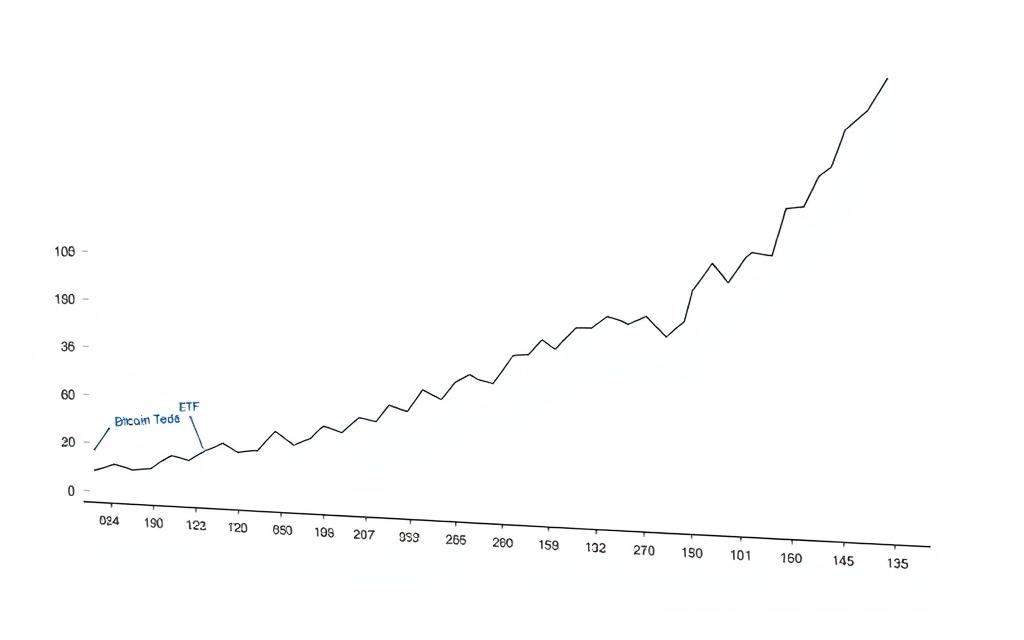

Bitcoin ETFs vs. Gold: A $36.8 Billion Shift

Spot bitcoin etfs dominated 2024 with $36.8 billion inflows, dwarfing gold’s $454 million. Products from BlackRock and Fidelity attracted most institutional capital.

Key differences emerged:

- ETFs offered easier exposure than physical gold

- Younger investors favored digital assets

- Inflation concerns drove both investment flows

Analysts’ Bullish Targets: $150,000-$200,000

Leading firms published ambitious 2025 forecasts. Standard Chartered maintains its $200,000 Bitcoin target, while Galaxy Digital predicts $185,000.

“ETF adoption could drive $70 billion in new inflows, reshaping the entire digital asset landscape.”

Bernstein analysts cite growing corporate adoption as another price catalyst. Their models suggest $150,000 prices remain achievable despite recent volatility.

Risks and Challenges for Crypto Under Trump

Security breaches and policy uncertainties create headwinds for investors. While optimism grows around potential regulatory shifts, several factors could dampen market progress. Careful evaluation helps navigate these complex dynamics.

Policy Delays and Trade War Volatility

Barclays analysts warn that delayed legislation may slow institutional adoption. Their 100-day progress report suggests key decisions might extend into 2026. This creates interim volatility for traders.

Trade tensions present another challenge. WisdomTree’s analysis shows proposed tariffs could:

- Increase mining equipment costs by 15-20%

- Reduce liquidity in Asian trading pairs

- Trigger defensive portfolio rebalancing

Security Concerns: Exchange Hacks and Liquidity Shocks

The $1.4B Bybit hack by Lazarus Group caused ETF outflows totaling $800M. Such incidents test investor confidence in exchange security. Federal Reserve reports now cite digital assets as potential systemic risks.

Key vulnerabilities include:

| Risk Type | Impact | Prevention |

|---|---|---|

| Hot wallet breaches | Immediate liquidity crisis | Multi-sig cold storage |

| Smart contract bugs | Protocol collapse | Third-party audits |

| Regulatory actions | Withdrawal freezes | Jurisdiction diversification |

Long-Term Viability vs. Speculative Hype

21Shares research questions whether cryptocurrencies can maintain inflation-hedge status during recessions. Their liquidation risk models show 40% correlation with traditional markets during stress periods.

Energy debates add complexity. Bitcoin’s consumption now rivals mid-sized nations, competing with AI sector demands. “The industry must address sustainability to ensure decades of growth,” notes a Galaxy Digital report.

“Market cycles don’t eliminate fundamental value, but they test conviction. The next two years will separate enduring projects from speculative excess.”

Conclusion: Balancing Optimism and Caution

The digital asset landscape remains fluid, with political and economic factors shaping its trajectory. While pro-growth rhetoric sparks optimism, execution challenges persist. The March 2025 White House summit may clarify policy directions, making it pivotal for investors.

Diversification aligns with Galaxy’s $140K forecast, but NY Fed warnings advise against overexposure. Volatility underscores the need for thorough research and risk management.

Key to watch: SEC appointments and progress on a strategic reserve asset. The coming years will demand agility amid shifting regulation and market trends.

FAQ

How could Trump’s policies impact cryptocurrency prices?

A Trump administration may push for favorable regulations, boosting investor confidence. Key moves like strategic Bitcoin reserves and supporting domestic mining could drive demand.

What are the risks for digital assets under Trump’s leadership?

Potential delays in policy implementation and trade-related volatility could create short-term instability. Security risks like exchange hacks remain a concern.

Could Bitcoin ETFs outperform gold under Trump?

Analysts suggest Bitcoin ETFs may attract capital from gold, with predictions of a .8 billion shift if regulatory support strengthens.

What price targets are experts forecasting for Bitcoin by 2025?

Some projections range between 0,000 and 0,000, driven by institutional adoption and potential pro-crypto policies.

How might a Trump presidency affect crypto mining in the U.S.?

Policies promoting domestic mining and opposing CBDCs could incentivize infrastructure growth, benefiting companies like Riot Platforms and Marathon Digital.

Are there concerns about long-term crypto sustainability under Trump?

While optimism exists, speculative hype and policy execution risks could challenge sustained growth. Investors should balance enthusiasm with caution.