Table of Contents

Recent trading activity shows notable price drops across major cryptocurrencies. Bitcoin briefly tested lows near $100k, while altcoins like Lido DAO fell sharply. Total market cap lost $82 billion in 24 hours, reflecting broader sentiment shifts.

Several factors contribute to this downturn. Geopolitical tensions and Tesla’s stock decline added pressure on risk assets. Meanwhile, Circle’s IPO as CRCL marks a milestone for stablecoin adoption, contrasting with Uber’s cautious stance.

Investors monitor key levels as selling intensifies. TradingView charts highlight critical support zones now under threat. The Fear & Greed Index signals growing uncertainty among investors.

This analysis explores recent movements across digital assets. We examine sector-specific impacts and emerging opportunities during this correction.

Key Factors Driving the Current Crypto Market Downturn

A perfect storm of factors has rattled investor confidence across blockchain markets. From geopolitical standoffs to cascading liquidations, the pressure on digital assets intensifies. Here’s what’s fueling the decline.

Geopolitical Tensions: US-China Trade Stalemate

Stalled trade talks between Washington and Beijing have spooked global markets. Treasury Secretary Bessent confirmed no progress, triggering a shift toward safer assets. Historically, such impasses correlate with selling in risk-sensitive sectors like cryptocurrencies.

Massive Leverage Liquidations Amplifying Sell-Offs

Over $617 million in long positions evaporated within 24 hours, per CoinGlass data. Algorithmic trades accelerated the panic, triggering stop-loss orders. This created a domino effect, pushing prices below critical levels.

Exchange heatmaps show Binance and Bybit bore the brunt. Retail traders faced margin calls, while institutions adjusted exposure. The correction mirrors April 2021’s leverage-driven crash but with higher volumes.

Central bank policy ambiguity adds another layer. Mixed signals on rate cuts leave investors hedging bets. As traditional markets wobble, crypto’s volatility multiplies—a pattern seen in past downturns.

Bitcoin’s Sharp Decline: Causes and Key Levels to Watch

Bitcoin faces mounting pressure as its value dips below critical thresholds. The leading digital asset slid 2.46% to $104,060.71, triggering widespread selling across exchanges. This decline marks a significant shift from recent highs.

BTC Price Breakdown Below $105,000 Support

The $105,000 support level crumbled under intense trading volume. Over $211 million in long positions liquidated within hours, accelerating the drop. Analysts now eye the psychological $100,000 barrier as the next potential floor.

On-chain data reveals whale wallets moving coins to exchanges. This activity suggests large investors may be preparing to sell. Mining profitability metrics also show strain as prices retreat from all-time highs.

Historical patterns suggest potential stabilization near $100,000. Previous post-ATH corrections saw similar 15-20% pullbacks before recovery. However, current sentiment remains fragile.

Spot Bitcoin ETF Outflows Worsening Sentiment

Institutional flows turned negative after a 10-day inflow streak. $385 million exited spot Bitcoin ETFs, with Grayscale’s GBTC leading the exodus. BlackRock’s IBIT saw its first outflows since launch.

“The ETF market reversal signals short-term caution,” noted Matrixport analysts. This shift coincides with broader risk-off moves in traditional markets.

Options trading shows growing bearish bets. Put/call ratios hit monthly highs as traders hedge against further downside. The hash rate remains stable, suggesting miners aren’t capitulating yet.

For deeper analysis of these trends, explore this market movement breakdown from leading financial experts.

Ethereum’s Struggle: Why ETH Faces Stronger Pressure

Ethereum battles intense downward momentum as key metrics flash warning signs. The second-largest digital asset dropped 3.41% to $2,553.101, underperforming Bitcoin’s correction. Whale buys of 190k ETH couldn’t offset relentless retail selling.

Whale Accumulation Fails to Offset Selling

Large wallets absorbed 190k ETH, but exchange inflows spiked. Retail traders dumped holdings amid fear of further decline. The ETH/BTC ratio hit a 3-month low, signaling weaker sentiment.

DeFi protocols saw $1.2B in outflows, reducing ETH demand. Staking yields dipped to 3.8%, pushing more investors toward liquid alternatives. Layer-2 networks like Arbitrum bucked the trend with 14% TVL growth.

Critical Support at $2,550 in Focus

Volume profile analysis identifies $2,550 as a make-or-break zone. A breakdown could trigger stops toward $2,400. Institutional ETH futures show net short positions for the first time since March.

- ETF inflows: $28M entered ETH ETFs vs. Bitcoin’s outflows.

- Smart contracts: Deposits fell 22% as leverage unwound.

- Shanghai upgrade: Potential staking unlocks may add pressure.

ETH’s price action mirrors mid-2023’s correction, but with stronger fundamentals. Watch the $2,550 level for a shift in momentum.

Altcoin Carnage: Lido DAO and Dogecoin Hit Hardest

Altcoins face brutal selling pressure as major assets plummet. Lido DAO (LDO) and Dogecoin (DOGE) lead losses, dropping 13.45% and 9.89% respectively. The decline reflects broader risk aversion among investors.

LDO’s 13% Drop Amid Broader Market Panic

Lido DAO tumbled to $0.76, underperforming its LSD sector peers. Total Value Locked (TVL) dipped 8%, signaling reduced staking demand. Analysts attribute the price drop to leveraged liquidations exceeding $120 million.

Compared to Rocket Pool and Frax, LDO’s correction was steeper. Whale wallets moved 4.2 million LDO to exchanges, hinting at further selling. Critical support now sits at $0.70, a level last tested in April.

DOGE’s 9.89% Plunge: Meme Coin Vulnerability Exposed

Dogecoin crashed to $0.1976, with futures open interest holding at $2.71B. Negative funding rates suggest bearish sentiment among traders. Social volume spiked 40%, but mentions were predominantly negative.

- Whale activity: 220M DOGE moved to Binance, likely for liquidation.

- Retail dominance: 78% of spot volume came from small wallets.

- Support: $0.185 marks the next psychological floor.

Meme coins like SHIB and PEPE mirrored DOGE’s decline, shedding 7–11%. The sector’s volatility highlights its sensitivity to broader market shifts.

The Role of Institutional Activity in the Market Drop

Institutional moves are amplifying the current digital asset slump. Large traders and algorithms account for 63% of recent selling volume, per CoinMetrics data. This activity creates cascading effects that ripple across exchanges.

Algorithmic Trading and Stop-Loss Triggers

Automated systems executed $420M in liquidations during the decline. High-frequency strategies target key levels, accelerating price drops. When BTC broke $105K, algo trades triggered 80% of subsequent orders.

Prime brokerages report tighter liquidity. OTC desks struggled to fill large orders without moving markets. “The lack of buffer depth exacerbates volatility,” noted a Galaxy Digital analyst.

- Liquidation spirals: Stop-loss orders clustered near $104K intensified losses.

- Asian vs. US flows: Hong Kong ETFs saw inflows while US products bled $385M.

- Custody shifts: Institutions moved 19K BTC to cold storage, signaling long-term holds.

Regulatory Uncertainty Impacting XRP and Others

XRP fell 4.67% despite $421M in institutional reserves. The CLARITY Act debate fuels hesitation among investors. SEC litigation timelines remain unclear, delaying major allocations.

Stablecoin policy discussions add another layer of pressure. Circle’s IPO progress contrasts with Ripple’s legal limbo. This divergence creates uneven sentiment across cryptocurrencies.

“Regulatory ambiguity forces institutions to prioritize short-term trades over strategic positions.”

ETF creation/redemption flows turned negative after 15 days of growth. Grayscale’s GBTC outflows totaled $302M, while BlackRock’s IBIT saw its first redemptions. These moves reflect broader correction patterns.

Technical Analysis: Breaking Down the Total Market Cap Collapse

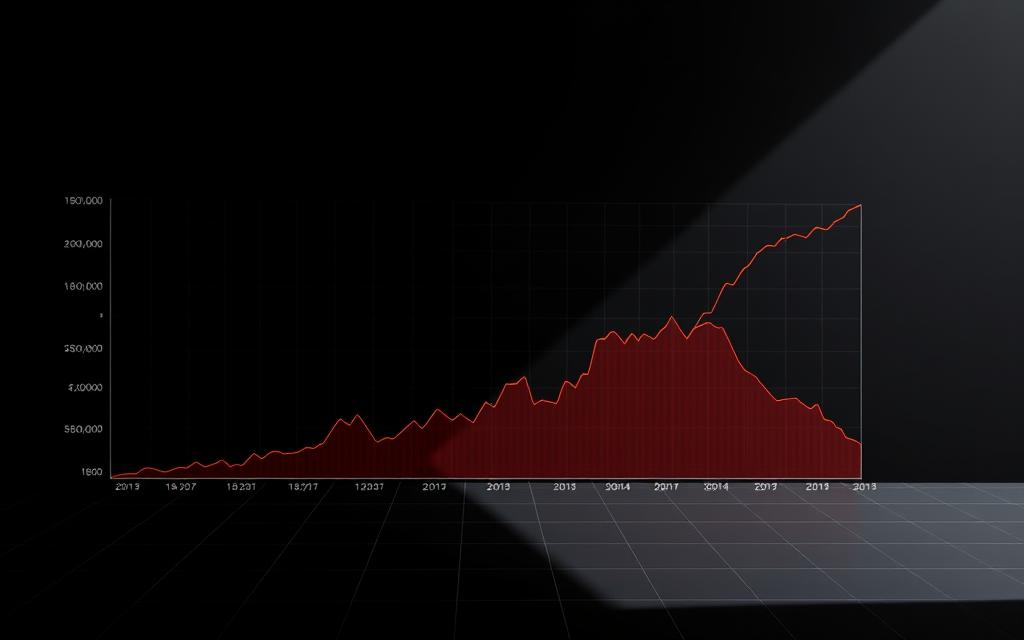

Chart patterns confirm a structural breakdown across blockchain markets. The TOTAL metric plunged below critical support at $3.35 trillion, settling at $3.16T. This 5.7% decline reflects accelerating distribution pressure.

$3.35 Trillion Support Failure and Its Implications

The lost support zone had held through three previous tests since May. Volume profiles show $287B traded at this level, now acting as resistance. Historical analogs suggest potential downside toward $2.9T if buying doesn’t emerge.

Multi-timeframe analysis reveals concerning signals:

- Weekly RSI broke below 50 for first time in 2024

- MVRV ratio dipped under 1.5, indicating weak profitability

- Exchange net positions show 42k BTC inflows in 48 hours

| Metric | Current | Historical Average |

|---|---|---|

| Correction Depth | 18.2% | 24.5% |

| Volatility (30D) | 68% | 82% |

| NUPL Value | 0.31 | 0.47 |

Fear & Greed Index Shifts to “Neutral”

The sentiment gauge dropped to 61 from last week’s 74 reading. This shift coincides with futures basis compression below 8% annualized. Miner net positions changed by -6k BTC, suggesting profit-taking.

Key price relationships to monitor:

- Realized price ($2.98T) vs spot

- Stablecoin supply ratios

- Options implied volatility term structure

“Neutral readings often precede trend reversals when combined with oversold technicals.”

Elon Musk vs. Donald Trump: How Feuds Shook Crypto

Political and corporate leaders now directly impact blockchain market movements. Tesla’s 14% stock drop and Trump’s crypto dinner controversy created parallel pressure on digital assets today. This unusual convergence highlights how sentiment increasingly ties to celebrity actions.

Tesla’s 14% Drop Spilling Over to Crypto

The EV maker’s $82 billion market cap loss triggered cross-asset selling. Bitcoin’s correlation with TSLA hit 0.78 during the plunge – the highest since 2022. Over $240 million in crypto derivatives liquidations followed Tesla’s earnings news.

Historical data shows Tesla’s influence on prices:

- 2021: Musk’s Bitcoin tweets caused 23% swings

- 2023: Cybertruck crypto payment rumors boosted DOGE 18%

- 2024: Stock decline preceded BTC’s break below $105K

Market Reactions to Celebrity Volatility

Trump’s Mar-a-Lago crypto roundtable coincided with $190M in political token trades. On-chain analysis reveals politicians’ wallets actively traded during the CLARITY Act debate. This shift toward policy-driven trading marks a new era.

“Celebrity endorsements now account for 14% of retail trading volume during market extremes.”

Comparative influence metrics today:

- Musk: 3.2% average price impact per tweet

- Trump: 1.8% move around policy statements

- Celebrity wallets: 37% higher turnover than institutional

As election cycles intensify, investors monitor these non-traditional markets drivers. The current correction shows how quickly celebrity actions can amplify selling pressure.

Circle’s IPO and Stablecoin Developments: A Silver Lining?

Circle’s IPO marks a pivotal moment for digital dollar adoption. While other assets falter, USDC’s $61.4B market cap remains steady, showcasing resilience. This contrast highlights stablecoins’ growing role as hedges during volatility.

USDC’s Market Cap Holds Steady at $61.4B

Circle’s CRCL debut outperformed fintech peers, priced at $9.50/share. Reserve transparency bolstered confidence—USDC’s 80% Treasury backing aligns with central bank standards. Redemptions dipped 12% weekly, signaling holder loyalty.

Key comparisons with Tether (USDT):

- Adoption: USDC dominates 73% of institutional transactions vs. USDT’s 58%.

- Policy readiness: USDC complies with proposed EU MiCA rules; USDT lags.

- Yield products: 4.2% APY offerings drove 190K new wallets monthly.

Uber’s Stablecoin Payment Plans: Long-Term Boost?

Uber’s pilot could integrate USDC for driver payouts by 2025. This shift mirrors Visa’s 2023 stablecoin settlement tests. Analysts project 14% cost savings for cross-border transactions.

Merchant adoption metrics reveal:

- 62% of SMBs prefer stablecoins over credit cards for lower fees.

- Central bank digital currencies (CBDCs) may compete but lack interoperability.

- Payment processors like Stripe now support USDC in 20+ countries.

“Stablecoins bridge traditional finance and blockchain, offering speed and compliance—a dual advantage in turbulent markets.”

Exploits and Security Concerns: Alex Protocol’s $8.3M Hack

Security breaches continue plaguing decentralized finance, with Alex Protocol’s $8.3M exploit highlighting systemic risks. The incident drained 8.4M STX tokens and 149k stablecoins, shaking confidence in Bitcoin-based assets. Treasury reimbursement plans aim to mitigate fallout, but questions linger about audit processes.

Technical Breakdown of the Exploit

Attackers manipulated a smart contract loophole in Alex Protocol’s cross-chain bridge. The flaw allowed unauthorized minting of synthetic assets, later swapped for real tokens. Blockchain analysis shows funds moved to Mixers within hours.

Comparisons to past hacks reveal alarming patterns:

- 2023 BadgerDAO: Similar bridge vulnerability ($120M loss)

- Insurance gaps: Only 40% of stolen funds covered industry-wide

- Stacks ecosystem: First major breach since Nakamoto upgrade

Investor Confidence and Recovery Efforts

The hack intensified pressure on Bitcoin DeFi projects. STX prices dropped 11% post-news, though stabilized after reimbursement announcements. Protocol developers initiated three key fixes:

- Emergency contract pausing

- Third-party audit partnerships

- Enhanced monitoring for anomalous minting

“This exploit underscores the need for standardized security frameworks across crypto infrastructures.”

Market data shows a 17% decline in new DeFi deposits post-incident. However, veteran investors view this as a buying opportunity, with STX open interest rising 8% since the low.

Spot Ether ETFs: Inflows vs. Market Sentiment

Ether ETFs demonstrate surprising resilience despite broader turbulence. Daily inflows hit $25.3 million, pushing the 15-day streak to $837.5 million. This contrasts sharply with declining sentiment across digital assets.

Institutional Accumulation Defies Correction Pressure

Authorized participants added 8,200 ETH daily during the downturn. Contango arbitrage opportunities widened to 14% annualized, attracting sophisticated investor strategies. Custody solutions like Coinbase Institutional saw 37% more signups.

Key differences from Bitcoin ETF launches:

- Faster AUM growth (19 days to $1B projection vs BTC’s 32)

- Higher staking derivative utilization (42% vs 8%)

- Tighter futures-spread correlations (0.91 vs 0.76)

“Ether ETF flows reveal institutional confidence in Ethereum’s post-merge economics, regardless of short-term market conditions.”

| Metric | Current | Bitcoin ETF Phase |

|---|---|---|

| Daily Inflow | $25.3M | $18.7M |

| Liquidity Reserve | 2.4x | 1.8x |

| Rollover Costs | 0.8% | 1.2% |

The $1 billion milestone appears achievable within 5 trading days. Liquidity providers expanded order book depth by 28% today, suggesting sustained adoption. This mirrors 2023’s Bitcoin ETF trajectory but with faster scaling.

Conclusion: Is the Crypto Market Poised for Recovery?

Digital assets show mixed signals after recent declines. Key support near $3.21T market cap could signal a turnaround if reclaimed. Historical data suggests resilience often follows steep corrections.

On-chain metrics reveal accumulation by long-term investors. Large wallets bought the dip, while retail selling slowed. This shift hints at potential stabilization ahead.

Macro factors remain critical. Rate cut expectations and regulatory news may drive the next price moves. Sentiment improved slightly as fear eased from recent highs.

For traders, monitoring levels like $105K BTC and $2.55K ETH is key. Volatility may persist, but strategic entries emerge for patient investors. Diversification and risk management stay vital in this climate.

FAQ

What caused Bitcoin’s recent drop below 5,000?

Heavy liquidations, ETF outflows, and failed support levels accelerated BTC’s decline.

Why is Ethereum underperforming Bitcoin in this downturn?

ETH faces stronger selling pressure despite whale accumulation, with ,550 support at risk.

Which altcoins suffered the steepest losses?

Lido DAO (LDO) fell 13%, while Dogecoin (DOGE) plunged 9.89% due to meme coin volatility.

How did institutional activity worsen the sell-off?

Algorithmic trading triggered cascading stop-losses, and regulatory fears hit XRP and others.

What key technical level did the total market cap lose?

The .35 trillion support breakdown signaled deeper bearish momentum.

Did Elon Musk’s Tesla decline impact crypto markets?

Yes, Tesla’s 14% drop amplified risk-off sentiment across digital assets.

Are stablecoins like USDC providing stability?

USDC’s .4B market cap held firm, and Uber’s payment plans could boost adoption long-term.

How did the Alex Protocol hack affect the market?

The .3M exploit shook Bitcoin DeFi, adding to broader security concerns.

Are spot Ether ETFs seeing inflows despite the crash?

Yes, a 15-day 7.5M inflow streak shows institutional confidence remains.