Table of Contents

Bitcoin mining is the backbone of the crypto industry, enabling the creation of new bitcoins and securing the decentralized network through transaction verification.

The process involves powerful computer hardware solving complex cryptographic puzzles to validate transactions and add them to the blockchain ledger.

As a critical component of the crypto ecosystem, mining serves two primary purposes: introducing new bitcoins into circulation and maintaining the integrity of the blockchain.

This comprehensive guide will walk you through the world of Bitcoin mining, covering essential concepts, hardware and software requirements, and best practices for optimizing your mining venture.

Understanding Bitcoin Mining

Bitcoin mining is a critical component of the Bitcoin network, enabling the validation of transactions and creation of new blocks. This process is fundamental to the operation and security of the Bitcoin ecosystem.

What is Bitcoin Mining?

Bitcoin mining refers to the process by which new Bitcoins are entered into circulation and transactions are verified and added to the public ledger, known as the blockchain. Miners use powerful computers to solve complex mathematical problems, which helps to secure the network and verify transactions.

The mining process involves competing to solve a cryptographic puzzle, with the first miner to solve it getting to add a new block of transactions to the blockchain and receiving a reward in the form of newly minted Bitcoins and transaction fees.

The Role of Miners in the Bitcoin Network

Miners play a crucial role in the operation of the Bitcoin network. They use their computing power to solve cryptographic problems, validating transactions and creating new blocks in the blockchain. This process not only secures the network but also verifies the legitimacy of transactions, preventing double-spending and other fraudulent activities.

- Miners function as a decentralized workforce, maintaining and securing the Bitcoin network.

- By validating transactions, miners prevent fraudulent activities and ensure the integrity of the blockchain.

- The collective work of miners creates an immutable record of transactions, becoming increasingly secure as more blocks are added.

| Role of Miners | Description | Impact on Network |

|---|---|---|

| Transaction Validation | Miners verify transactions to prevent double-spending. | Enhances network security. |

| Blockchain Maintenance | Miners add new blocks to the blockchain. | Ensures the integrity of the blockchain. |

| Network Security | Miners secure the network through cryptographic solutions. | Prevents fraudulent activities. |

How Bitcoin Mining Works

The bitcoin mining process relies heavily on the ability of miners to solve complex mathematical problems, which in turn validates transactions and creates a new block.

Proof of Work Consensus Mechanism

Bitcoin’s Proof of Work (PoW) consensus mechanism is the backbone of its mining process. This mechanism requires miners to solve complex mathematical problems, which helps in validating transactions and securing the network. The PoW ensures that the creation of new blocks is a computationally intensive task, making it difficult for malicious actors to manipulate the blockchain.

Solving Complex Mathematical Problems

Miners take the information that needs encoding — such as transaction data, the timestamp, and the block header — and add random data (a value called the “nonce”) until the algorithm produces a hash that meets the target difficulty. On average, miners need to perform approximately 464 sextillion trial-and-error operations to achieve a hash with 20 leading zeroes and the correct high-order numbers. The process involves:

- Solving complex mathematical problems that are actually cryptographic hash functions requiring massive computational trial and error.

- Finding a specific hash value that begins with a certain number of zeros, with the difficulty level determining how many zeros are required.

- Generating a block header hash that is less than or equal to the current target value set by the network difficulty.

Different Ways to Farm Bitcoin

Bitcoin mining can be approached in several ways, each with its unique advantages and challenges. The choice of method depends on factors such as available capital, technical expertise, and risk tolerance.

Solo Mining

Solo mining involves individuals mining Bitcoin independently without joining a mining pool. This approach requires significant hardware investment and technical knowledge. Solo miners receive the full reward for their mined blocks but face higher risks due to the competitive nature of Bitcoin mining.

Pool Mining

Pool mining allows miners to combine their resources, increasing their chances of solving complex mathematical problems. By joining a mining pool, miners can share the rewards based on their contributed hash power. This method reduces the variance in income and provides a more consistent reward stream.

Cloud Mining

Cloud mining involves leasing mining hardware or hash power from third-party providers. This method eliminates the need for maintaining physical equipment and managing operational costs. However, it often involves contracts and fees, and profitability can vary based on market conditions.

| Mining Method | Initial Investment | Technical Expertise Required | Risk Level |

|---|---|---|---|

| Solo Mining | High | High | High |

| Pool Mining | Medium | Medium | Medium |

| Cloud Mining | Low to Medium | Low | Medium to High |

Essential Equipment for Bitcoin Mining

Bitcoin mining requires specialized equipment to solve complex mathematical problems. The right hardware is crucial for successful mining operations.

ASIC Miners

Application-Specific Integrated Circuit (ASIC) miners are the most efficient hardware for Bitcoin mining. They are designed specifically for solving the cryptographic algorithms used in Bitcoin mining.

GPU Mining Rigs

GPU mining rigs utilize multiple graphics cards working in parallel to solve the cryptographic puzzles required for Bitcoin mining. Although less efficient than ASICs for Bitcoin, GPU rigs offer versatility and can be used for mining other cryptocurrencies.

GPU mining rigs typically consist of multiple graphics cards, a motherboard, a power supply unit, a processor, memory, and storage. They require careful consideration of power delivery and cooling systems.

Bitcoin Mining Software Options

Bitcoin mining software options vary widely, catering to different types of miners and hardware configurations. The right software can significantly enhance your mining efficiency and overall profitability.

CGMiner

CGMiner is a popular, open-source Bitcoin mining software known for its compatibility with various hardware, including ASIC and FPGA devices. It offers advanced features such as overclocking and monitoring, making it a favorite among experienced miners.

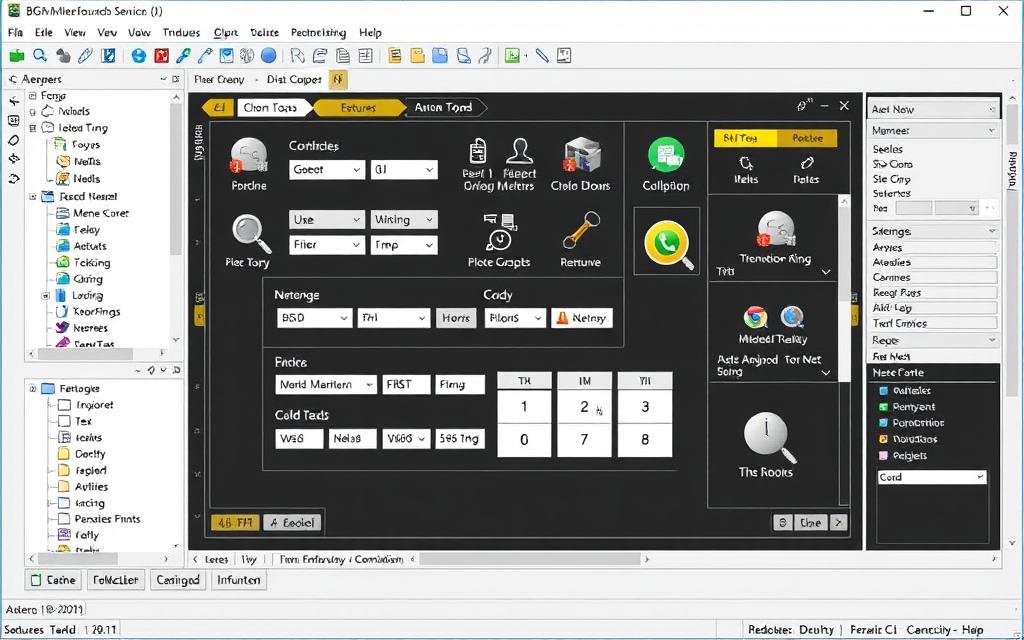

BFGMiner

BFGMiner is another versatile mining software that supports both ASIC and FPGA hardware. It offers detailed monitoring and control capabilities, allowing miners to optimize their operations effectively.

EasyMiner

EasyMiner is a user-friendly option for those new to crypto mining. It provides a graphical interface and works well with both ASIC and GPU setups. Key features include:

- A graphical user interface (GUI) that simplifies the Bitcoin mining process.

- Compatibility with various mining backends like CGMiner and BFGMiner.

- A “MoneyMaker” mode for streamlined setup and immediate mining.

- Real-time statistics and visualization tools for monitoring operations.

- Support for both solo and pool mining configurations.

- Built-in wallet management features for tracking earnings.

EasyMiner is an excellent entry point for newcomers to Bitcoin mining, offering both accessibility and advanced features.

Setting Up Your Bitcoin Wallet

Establishing a Bitcoin wallet is a critical step for miners to secure their mining rewards. This process involves selecting the right type of wallet and implementing robust security measures to protect your assets.

Types of Bitcoin Wallets

Bitcoin wallets come in various forms, each with its own set of features and security levels. The primary types include hardware wallets, software wallets, and paper wallets. Hardware wallets offer superior security by storing private keys offline, while software wallets provide convenience and ease of use. Paper wallets, though less common, can be a secure option for long-term storage.

Securing Your Mining Rewards

Securing your mining rewards is paramount to prevent loss or theft. Implementing robust private key management practices is the first step. Using hardware wallets can significantly enhance security by isolating private keys from internet-connected devices. Regular backups of wallet recovery phrases and private keys, stored in multiple secure locations, are also crucial. Additionally, employing multi-signature security protocols and maintaining operational compartmentalization can further protect your mining rewards.

- Use hardware wallets for enhanced security.

- Regularly backup wallet recovery phrases and private keys.

- Implement multi-signature security protocols for added protection.

How to Farm Bitcoin: Step-by-Step Process

To start farming Bitcoin, you’ll need to follow a series of steps that involve setting up your hardware, software, and joining a mining pool.

Setting Up Your Mining Hardware

Setting up your mining hardware involves configuring your ASIC miners or GPU mining rigs. Ensure your equipment is properly connected and cooled to optimize performance.

For optimal results, consider the power consumption and hash rate of your mining hardware.

Installing and Configuring Mining Software

After setting up your hardware, you’ll need to install and configure mining software such as CGMiner or BFGMiner. These programs connect your hardware to the mining pool.

Configuration involves entering your worker ID and pool details to start mining.

Joining a Mining Pool

Joining a mining pool is crucial for consistent rewards. Research and select a reputable pool like F2Pool or Antpool that aligns with your mining goals.

To join a mining pool, you’ll need to provide the pool URL, your worker ID, and your Bitcoin wallet address. Popular pools offer different advantages in terms of server locations and user interface.

- Research and select a pool based on factors like pool size, fee structure, and payout methods.

- Configure your mining software with the pool’s connection details.

- Monitor your mining operation through the pool’s dashboard.

By following these steps, you can effectively start mining Bitcoin and mine bitcoin efficiently.

Optimizing Your Mining Operation

Effective optimization of your mining operation can significantly impact your bottom line. To achieve this, focus on two critical areas: cooling solutions and power management.

Cooling Solutions

Bitcoin mining generates significant heat, which can damage hardware and increase energy costs. Effective cooling solutions are essential to maintain optimal operating temperatures.

Power Management

Effective power management is crucial for profitable Bitcoin mining, as electricity costs typically represent 70-80% of ongoing operational expenses. To optimize power management:

- Negotiate special electricity rates with utility companies or relocate to regions with lower energy costs.

- Implement power distribution units (PDUs) with remote monitoring capabilities.

- Use high-quality mining PSUs with 90%+ efficiency ratings to reduce electricity costs and heat generation.

- Employ load balancing across multiple circuits to prevent overloading.

- Utilize automated power management systems to adjust mining intensity based on electricity pricing.

By implementing these strategies, miners can significantly reduce their operational costs and improve profitability.

Understanding Mining Economics

The economics behind Bitcoin mining play a significant role in determining the profitability and sustainability of mining operations. It involves understanding various factors that impact the revenue and expenses associated with mining Bitcoins.

Mining Difficulty and Its Impact

Mining difficulty is a critical factor in mining economics. It refers to the complexity of the mathematical problems that miners must solve to validate transactions and create a new block on the blockchain. As more miners join the network, the difficulty increases, making it harder to solve these problems and reducing the profitability for individual miners. This adjustment happens approximately every two weeks to maintain a consistent block creation rate.

Bitcoin Halving Events

Bitcoin halving events occur approximately every four years, reducing the block reward by 50%. This programmed supply reduction is fundamental to Bitcoin’s monetary policy, gradually decreasing the rate of new coin issuance. Historically, these events have preceded significant price increases, potentially offsetting the reduction in block reward for miners. As noted by experts, “The halving cuts the block reward in half, reducing miners’ revenue in Bitcoin terms by 50%.” Miners must adapt to these changes by improving efficiency or reducing costs to remain profitable. For more information on how blockchain technology can be utilized, visit ways to make money with blockchain.

Calculating Bitcoin Mining Profitability

Assessing the profitability of bitcoin mining is vital for making informed investment decisions. To determine whether mining is a viable venture, one must consider several key factors.

Key Factors Affecting Profitability

The profitability of bitcoin mining is influenced by several critical factors, including the hash rate of your mining hardware, electricity costs, and the current Bitcoin price. Other significant factors include the difficulty level of the mining process and the efficiency of your mining equipment. Understanding these elements is crucial for estimating potential profits.

Using Mining Calculators

To simplify the process of estimating mining profitability, various online calculators are available. Websites such as CryptoCompare and CoinWarz offer precise profitability calculators that take into account factors like hash rate, energy consumption, and electricity costs. These tools provide miners with realistic projections based on their specific operational parameters, helping them make informed decisions.

Risks and Challenges in Bitcoin Mining

Bitcoin mining is fraught with several risks that can significantly impact its profitability. Understanding these challenges is crucial for anyone considering engaging in this activity.

Market Volatility

The value of Bitcoin can fluctuate wildly, affecting the mining rewards. When the value drops, it can become unprofitable to mine, especially if electricity costs are high. Miners must be prepared for such fluctuations.

Hardware Obsolescence

The rapid advancement in mining hardware technology means that equipment can become obsolete quickly. Miners need to continually upgrade their hardware to remain competitive, which can be capital-intensive.

Regulatory Concerns

Regulatory environments vary significantly across jurisdictions, impacting mining operations. Some countries have banned mining altogether, while others impose strict regulations, including special electricity tariffs for mining. The lack of consistent regulation can lead to operational risks.

| Risk Factor | Description | Impact on Mining |

|---|---|---|

| Market Volatility | Fluctuations in Bitcoin’s value | Affects profitability |

| Hardware Obsolescence | Rapid advancements in mining technology | Requires frequent hardware upgrades |

| Regulatory Concerns | Varying regulations across jurisdictions | Operational risks and compliance challenges |

Sustainable Bitcoin Mining Practices

Sustainable Bitcoin mining practices are gaining traction as miners seek to minimize their environmental impact while maintaining profitability. The industry’s shift towards sustainability is driven by the need to reduce operational costs and mitigate the environmental concerns associated with energy-intensive mining.

Renewable Energy Adoption

Bitcoin miners are increasingly adopting renewable energy sources to power their operations. Hydroelectric power is becoming a popular choice due to its reliability and low carbon footprint. By leveraging renewable energy, miners can significantly reduce their reliance on fossil fuels and lower their electricity costs.

Reducing Environmental Impact

Beyond renewable energy adoption, Bitcoin miners are implementing various strategies to reduce their environmental footprint. Some of these strategies include:

- Implementing heat recovery systems to capture and repurpose thermal output for space heating, agricultural applications, or industrial processes.

- Using immersion cooling to extend hardware lifespan and reduce noise pollution.

- Participating in carbon offset programs to compensate for emissions that cannot be eliminated.

- Optimizing location to take advantage of excess energy capacity and cooler climates.

- Engaging in demand response programs to act as flexible load resources for electrical grids.

- Implementing hardware recycling initiatives to recover valuable materials from obsolete mining equipment.

- Publishing transparency reports to disclose energy sources, consumption metrics, and carbon footprint calculations.

By adopting these sustainable practices, Bitcoin miners can reduce their environmental impact while maintaining the security and integrity of the Bitcoin network.

Conclusion

The process of mining Bitcoin is complex, involving technological, economic, and environmental considerations. As outlined in this guide, successful Bitcoin mining requires a comprehensive understanding of hardware selection, software configuration, and operational optimization. The mining industry’s cyclical nature, influenced by Bitcoin’s price and difficulty adjustments, presents both challenges and opportunities. To mine bitcoin profitably, one must balance these factors while considering profitability. As the crypto landscape evolves, sustainable mining practices are becoming increasingly important. By adopting efficient operations and managing costs, miners can navigate the complexities of Bitcoin mining and contribute to the security and integrity of the crypto network.

FAQ

What is the primary purpose of Bitcoin mining?

The primary purpose of Bitcoin mining is to secure the Bitcoin network and verify transactions, ensuring the integrity of the blockchain. Miners are rewarded with newly minted Bitcoins and transaction fees for their efforts.

What is the difference between solo mining and pool mining?

Solo mining involves mining Bitcoins independently, relying on individual mining hardware to solve complex mathematical problems. In contrast, pool mining allows multiple miners to combine their resources, increasing their chances of solving these problems and earning rewards.

What is the role of Application-Specific Integrated Circuit (ASIC) miners in Bitcoin mining?

ASIC miners are specialized mining hardware designed to optimize Bitcoin mining performance. They offer higher hash rates and improved energy efficiency compared to traditional GPU mining rigs, making them a popular choice among miners.

How does the Bitcoin network adjust its mining difficulty?

The Bitcoin network adjusts its mining difficulty every 2016 blocks, or approximately every two weeks. This adjustment ensures that the block creation rate remains relatively stable, despite changes in the total mining power of the network.

What is the impact of Bitcoin halving events on mining economics?

Bitcoin halving events, which occur every 210,000 blocks, reduce the block reward by half. This reduction can lead to increased mining difficulty and decreased mining profitability if not offset by rising Bitcoin prices or improved mining efficiency.

How can miners optimize their mining operation for better profitability?

Miners can optimize their operation by implementing effective cooling solutions, managing power consumption, and selecting the most profitable mining pools. Additionally, using mining calculators can help estimate mining profitability based on various factors, including mining difficulty and energy costs.

What are the environmental concerns associated with Bitcoin mining?

Bitcoin mining consumes significant amounts of energy, contributing to greenhouse gas emissions and environmental concerns. To mitigate this, some miners are exploring the use of renewable energy sources and implementing sustainable mining practices.

What are the risks associated with investing in Bitcoin mining hardware?

Investing in Bitcoin mining hardware carries risks, including hardware obsolescence, market volatility, and regulatory concerns. Miners must carefully consider these factors before investing in mining equipment.