Table of Contents

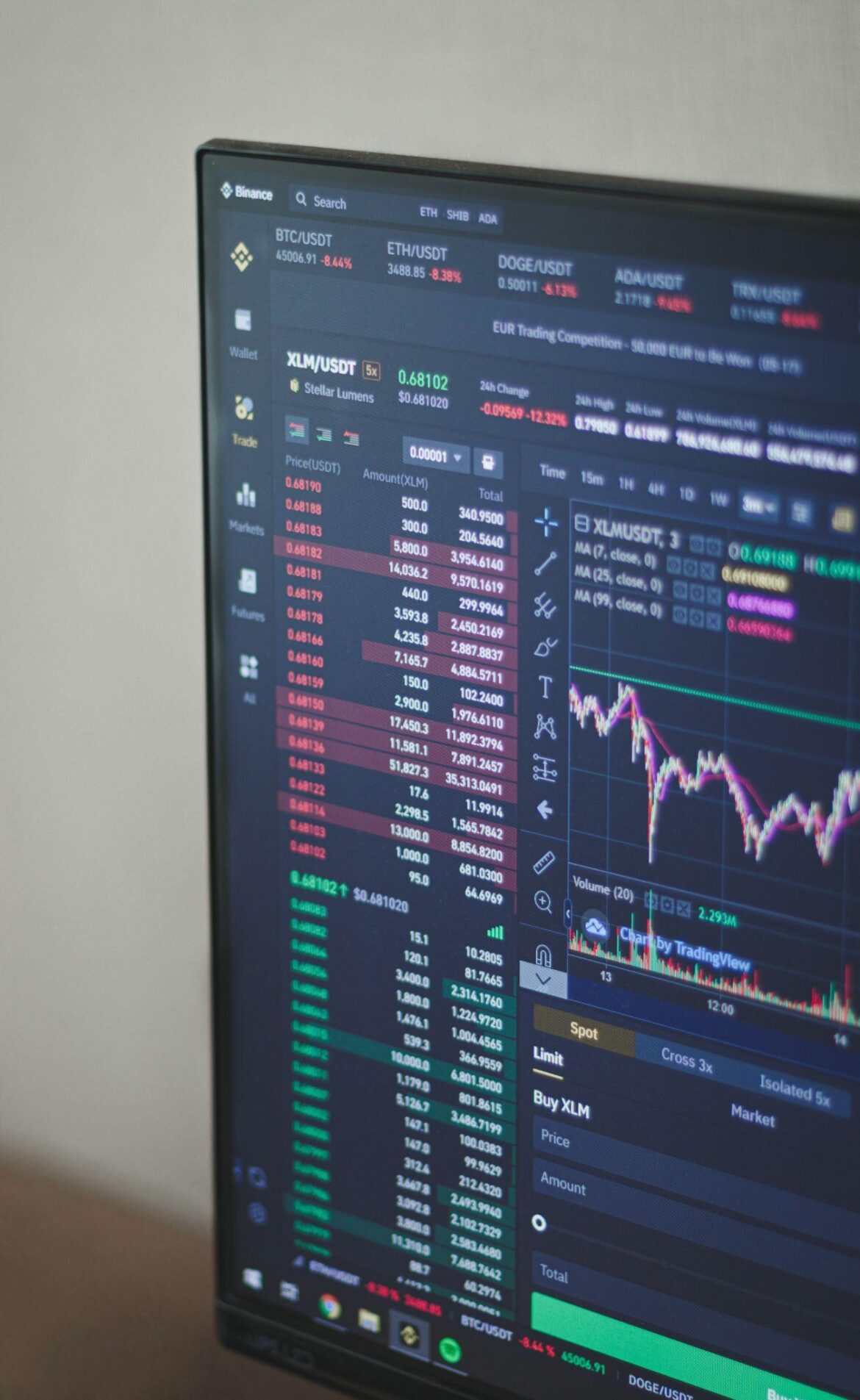

Cryptocurrency trading has surged in popularity, attracting both novice and experienced investors. The allure of high returns and the dynamic nature of the market have created a thriving ecosystem. Traders are constantly seeking innovative ways to maximize their profits and minimize risks.

In this competitive landscape, staying ahead requires more than just luck or intuition. Traders need sophisticated tools and strategies to navigate the volatile market successfully. The need for cutting-edge technology has never been more crucial for achieving consistent trading success.

Enter the AI trader bot, a revolutionary tool designed to enhance trading efficiency and profitability. These bots leverage advanced algorithms and machine learning to automate trading decisions, offering a significant edge to traders. AI trader bots are transforming the way traders interact with the market, making it easier and more effective to capitalize on trading opportunities.

Benefits of Using AI Trader Bots

One of the primary advantages of AI trader bots is their ability to trade 24/7. Unlike human traders, bots do not need rest, ensuring that trading opportunities are never missed, regardless of the time zone. This continuous operation is particularly beneficial in the cryptocurrency market, which operates around the clock and experiences frequent price fluctuations.

Emotionless trading is another critical benefit. Human emotions like fear and greed can cloud judgment and lead to poor trading decisions. AI trader bots, however, execute trades based purely on data and predefined strategies, eliminating emotional bias. This objective approach can significantly enhance trading outcomes by ensuring that decisions are made logically and consistently.

Key Features of AI Trader Bots

AI trader bots are equipped with various features designed to optimize trading performance. Real-time market analysis and prediction capabilities enable bots to make informed decisions based on current market conditions. By continuously monitoring market trends and analyzing historical data, these bots can generate accurate trading signals.

Automated trading signals and execution ensure that trades are carried out precisely and promptly. This automation reduces the risk of human error and enhances the consistency of trading outcomes. Traders can set specific criteria for trade execution, allowing the bot to operate independently and make decisions that align with the trader’s strategy.

Backtesting and strategy optimization tools allow traders to test their strategies against historical data. This feature helps refine trading approaches and improve future performance. By simulating trades based on past market conditions, traders can identify potential weaknesses in their strategies and make necessary adjustments.

Risk management tools, including stop-loss mechanisms, are integral to AI trader bots. These tools help mitigate potential losses by automatically closing positions when certain conditions are met. For example, a stop-loss order can be set to sell a cryptocurrency if its price falls below a specified level, preventing further losses in a declining market.

Popular AI Trader Bots in the Market

Several AI trader bots have gained prominence in the cryptocurrency trading community. 3Commas, and Shrimpy are among the leading options, each offering unique features and benefits.

3Commas stands out for its advanced automation features and integration with numerous exchanges. It offers a wide array of tools for strategy optimization and risk management. 3Commas also provides a smart trading terminal that allows users to manage all their exchange accounts from a single interface, simplifying the trading process.

Shrimpy, on the other hand, focuses on portfolio management and social trading. It allows users to follow and copy the strategies of successful traders, making it an excellent choice for beginners. Shrimpy’s social trading features enable users to learn from experienced traders and improve their own strategies over time.

Setting Up and Using an AI Trader Bot

Choosing the right AI trader bot is crucial for achieving optimal results. Traders should consider factors such as the bot’s features, pricing, and user reviews before making a decision. It’s essential to select a bot that aligns with the trader’s goals and provides the necessary tools for their preferred trading strategy.

The installation and configuration process typically involves creating an account, connecting the bot to a trading platform, and setting up trading parameters. Most bots offer detailed guides and customer support to assist with this process. For example, CryptoHopper provides step-by-step tutorials and a responsive support team to help users get started.

Optimizing bot performance requires regular updates and monitoring. Traders should periodically review and adjust their strategies based on market conditions and bot performance. Fine-tuning these strategies can significantly enhance trading outcomes. For instance, a trader might adjust the bot’s parameters to react more aggressively during periods of high market volatility and more conservatively during stable periods.

It’s also important to stay informed about the latest developments in AI and cryptocurrency trading. Continuous learning and adaptation are key to maintaining a competitive edge in the market. Many AI trader bots offer educational resources, such as webinars and articles, to help users stay up-to-date with industry trends and best practices.

Risks and Considerations

While AI trader bots offer numerous benefits, they also come with potential risks. Technical failures, such as software glitches or connectivity issues, can disrupt trading activities and lead to losses. It’s essential to choose a bot with a reliable track record and robust technical support to minimize these risks.

Market volatility is another risk factor. Rapid price fluctuations can result in significant losses if not properly managed. Traders must ensure that their bots are equipped with robust risk management tools. For example, setting appropriate stop-loss and take-profit levels can help protect against sudden market movements.

Regulatory concerns are also important to consider. The regulatory landscape for cryptocurrency trading is still evolving, and traders must stay informed about legal requirements and compliance issues. Some regions have specific regulations regarding automated trading, and it’s crucial to ensure that the chosen bot complies with these rules.

Conducting thorough research before choosing an AI trader bot is essential. Traders should evaluate the bot’s track record, user feedback, and security measures to ensure reliability and effectiveness. It’s also beneficial to test the bot with a small amount of capital before committing significant funds to ensure that it performs as expected.

Balancing automation with human oversight is critical. While AI trader bots can handle many aspects of trading, human judgment is still necessary for strategic decision-making and risk management. Traders should regularly monitor bot performance and be prepared to intervene if necessary. Combining the strengths of AI and human intuition can lead to more effective trading outcomes.

Conclusion

AI trader bots present a significant opportunity for cryptocurrency traders to enhance their strategies and improve trading outcomes. The benefits of continuous operation, emotionless trading, speed, and customization make these tools indispensable in the fast-paced world of crypto trading. Traders who leverage AI technology can gain a competitive edge and achieve more consistent profitability.

As the technology continues to evolve, staying informed and adapting to new developments will be crucial for traders seeking to maintain a competitive edge. By leveraging the power of AI trader bots, traders can navigate the complexities of the cryptocurrency market with greater confidence and success. The future of cryptocurrency trading is undoubtedly intertwined with the advancements in AI, promising exciting possibilities for traders worldwide.