Table of Contents

Navigating tax obligations for digital assets can feel overwhelming. The IRS classifies cryptocurrency as property, meaning every trade or sale may trigger a taxable event. Proper reporting ensures compliance and avoids penalties.

With increased IRS enforcement, maintaining accurate records is crucial. Tools like TurboTax Premium simplify tracking up to 20,000 transactions. This helps classify capital gains and ordinary income correctly.

Whether you’re new to crypto taxes or an experienced trader, understanding the basics protects against audits. The following guide breaks down complex concepts into actionable steps for your tax return.

Understanding Cryptocurrency Taxes

Tax rules for crypto assets often confuse even experienced investors. The IRS treats these digital holdings as property, not currency, triggering unique reporting requirements. Every trade, sale, or exchange could create a taxable event.

Why Cryptocurrency Is Taxable

In 2014, the IRS issued Notice 2014-21, clarifying that virtual currencies are property. This means:

- Crypto-to-crypto trades are taxable, even if no cash is exchanged.

- Mining or staking rewards count as ordinary income at fair market value.

- Gifts or donations may have capital gains implications.

IRS Classification of Cryptocurrency

The IRS focuses on three key areas for compliance:

- Investment vs. personal use: Buying a coffee with crypto differs from trading.

- Cost basis tracking: Fees and commissions adjust profit calculations.

- Audit triggers: Large transactions or inconsistent reporting raise flags.

Passive holders still report gains when selling, while active traders face stricter scrutiny. Proper classification avoids penalties and simplifies filings.

How to Do Taxes on Cryptocurrency: A Step-by-Step Guide

Accurate crypto record-keeping forms the foundation of compliant filings. The IRS requires documentation for every transfer, trade, or disposal. TurboTax and similar platforms now support automatic import of up to 20,000 transactions across wallets.

Step 1: Track All Your Transactions

Consolidate records from exchanges, DeFi platforms, and cold wallets. Critical details include:

- Date and time of each movement

- USD value at transaction execution

- Wallet addresses involved

“Virtual currency exchanges may be required to report certain information to the IRS.”

Step 2: Calculate Your Gains and Losses

A $1,000 Bitcoin purchase sold for $1,200 creates $200 in taxable gains. Always subtract:

- Original purchase price (cost basis)

- Transaction fees

- Network costs

| Method | Advantage | Best For |

|---|---|---|

| FIFO | Simplest to calculate | Simple portfolios |

| Specific ID | Maximizes losses | Active traders |

Step 3: Determine Holding Periods

Assets held under 12 months incur ordinary income rates (10-37%). Long-term holdings qualify for reduced 0-20% capital gains rates. Mark acquisition and disposal dates clearly.

Proper classification ensures accurate tax return submissions. Software like CoinTracker automatically tags transactions by duration.

Key Tax Forms for Cryptocurrency

Filing crypto-related taxes requires accurate documentation on specific IRS forms. The agency scrutinizes digital asset transactions, making proper form selection and completion critical. Below are the essential forms for reporting gains, losses, and income.

Form 1040 and Schedule D

The 2024 Form 1040 includes a crypto checkbox under income sources. Taxpayers must answer truthfully, even if only holding assets. Schedule D reconciles capital gains from Form 8949, summarizing net profits or losses.

Form 8949 for Detailed Transactions

This form itemizes every sale or exchange. Columns A-F capture:

- Asset descriptions and dates acquired/sold

- Cost basis and proceeds

- Adjustments for fees or missing 1099-B forms

“Incomplete Form 8949 filings are a common audit trigger.”

Form 1099-MISC and 1099-NEC for Income

Mining rewards or crypto payments for services may generate these forms. Report mining income on Schedule C if classified as self-employment. Thresholds apply:

- $600+ for 1099-MISC/NEC reporting

- No minimum for taxable mining revenue

Accurately report crypto activities across these forms to minimize audit risks.

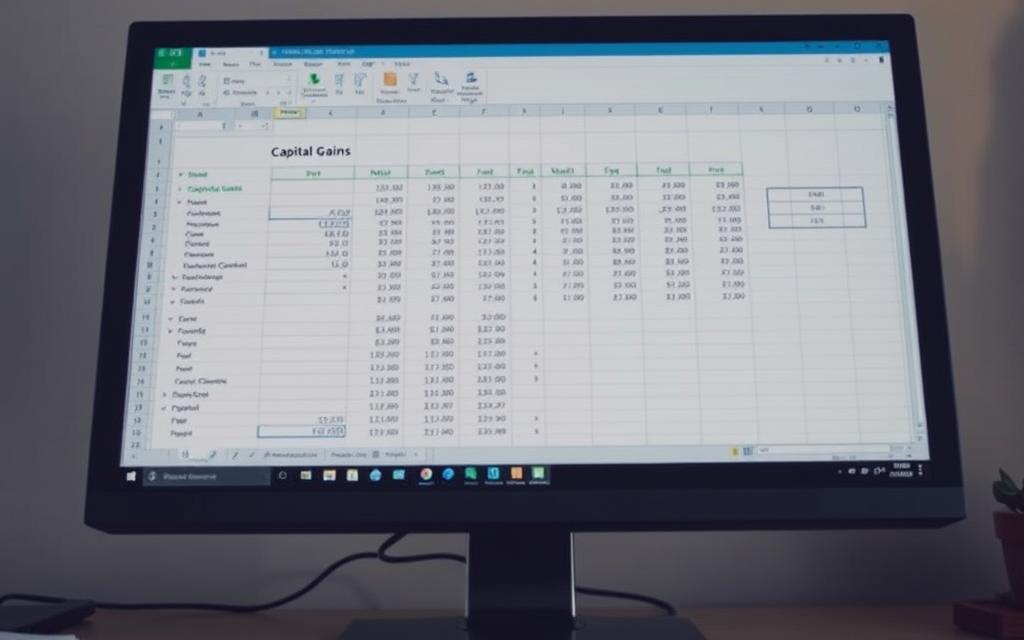

Calculating Capital Gains and Losses

Capital gains and losses form the backbone of crypto tax reporting. Properly tracking these figures ensures compliance and maximizes deductions. The IRS treats digital assets like stocks, requiring detailed records of every transaction.

Understanding Cost Basis

Your cost basis is the original purchase price plus fees. For example, buying Litecoin for $300 with a $10 fee sets a $310 basis. Selling it later for $500 yields a $190 gain ($500 – $310).

Airdrops and forks complicate calculations. Their basis equals the fair market value when received. Missing this step risks underreporting gains.

Adjusting for Fees and Commissions

Transaction fees reduce taxable profits. Use this formula:

- Gain = (Sale price – fees) – (Purchase price + fees)

For instance, a $1,000 sale with $20 in fees and a $700 purchase with $15 in fees creates a $265 gain ($980 – $715).

| Method | Impact on Gains | Best Used When |

|---|---|---|

| FIFO | Uses oldest assets first | Simplifying complex portfolios |

| Specific ID | Selects high-cost lots | Minimizing taxable amounts |

“Wash sale rules don’t apply to crypto, but improper loss claims trigger audits.”

Losses offset gains dollar-for-dollar. Exceeding $3,000 in net losses carries forward to future years. Meticulous tracking ensures you claim every deduction legally.

Reporting Cryptocurrency Income

Earning digital assets through mining or services creates unique reporting challenges. The IRS treats these earnings as taxable income, whether received as block rewards or payment. Proper classification prevents audit triggers and ensures accurate filings.

Mining and Staking Income

Proof-of-work miners must report rewards as ordinary income at fair market value when received. This applies even if assets aren’t immediately sold. Key considerations:

- Self-employment taxes apply if mining constitutes a business

- Equipment costs may qualify as deductible expenses

- Staking rewards follow similar rules to mining income

“Virtual currency received as payment for services is includible in gross income.”

Payment for Goods and Services

Accepting crypto for work or products triggers income recognition at USD value when received. Businesses issuing $600+ payments must file Form 1099-NEC. Special rules apply:

| Income Type | Reporting Form | Tax Treatment |

|---|---|---|

| Freelance work | 1099-NEC | Subject to self-employment tax |

| Merchant sales | 1099-K | Barter exchange rules apply |

| Gig economy | Schedule C | Deductible expenses allowed |

Track the USD value at transaction time throughout the year. Crypto-to-crypto payments still require conversion to fiat equivalents for reporting.

Special Cases in Cryptocurrency Taxation

Unique tax scenarios emerge with certain crypto activities. Protocol upgrades, donations, and gifts follow distinct IRS rules. Proper handling avoids audits and maximizes deductions.

Airdrops and Hard Forks

The 2019 IRS guidance clarified that hard fork coins are taxable income. Basis allocation starts at fair market value when received. Key considerations:

- Protocol upgrades: Hard forks may create new assets with separate tax implications.

- Airdrops require valuation on receipt date, even if unsolicited.

- Lost or inaccessible crypto rarely qualifies for deductions.

“Taxpayers must report forks and airdrops as ordinary income unless excluded by law.”

Charitable Contributions and Gifts

Donating digital assets to nonprofits can yield deductions. Rules differ from cash gifts:

- Over $250: Written acknowledgment from the charity is mandatory.

- Gifts exceeding $17,000 annually may trigger gift tax reporting.

- Basis transfers to recipients, affecting their future transactions.

For strategies to minimize capital gains, keep detailed records of donation dates and valuations.

Tax Implications of Crypto Trading

Trading digital assets creates distinct tax scenarios requiring careful analysis. Unlike traditional investments, every wallet transfer or exchange may trigger reporting requirements. The IRS scrutinizes these activities through Form 8949 filings.

Buying and Holding Cryptocurrency

Purchasing crypto alone isn’t taxable, but disposal methods determine liabilities. Key considerations:

- Retirement accounts: IRAs and 401(k)s defer taxes until withdrawal

- Cold storage holdings avoid annual reporting unless sold

- Staking rewards count as income upon receipt

“Taxpayers must report virtual currency transactions regardless of amount.”

Selling or Exchanging Cryptocurrency

Crypto-to-crypto swaps now qualify as taxable events. The 2018 Tax Cuts Act eliminated like-kind exchange benefits. Traders face:

- Short-term rates (10-37%) for assets held under 12 months

- Long-term rates (0-20%) for extended holdings

- Network fees reducing taxable amounts

| Strategy | Tax Impact | Best For |

|---|---|---|

| Tax-loss harvesting | Offsets capital gain | Volatile markets |

| HODLing | Qualifies for lower rates | Long-term investors |

| DeFi liquidity pools | Complex cost basis tracking | Advanced traders |

High-frequency traders face additional scrutiny. The IRS may classify frequent crypto transactions as business income. Professional tax software helps navigate these complexities.

How to Report Crypto Transactions

Modern tax software transforms complex crypto reporting into manageable workflows. Whether you’re reconciling exchange data or preparing Form 8949, specialized tools adapt to various needs. The IRS requires complete transaction histories, making organization paramount.

Automated Solutions for Seamless Filing

Leading platforms like CoinLedger automatically generate IRS-ready forms. Key features include:

- API integration with 300+ exchanges

- Real-time capital gains calculations

- Audit trails documenting cost basis methods

TurboTax Premium now syncs with Coinbase, simplifying information transfer. Comparative analysis shows:

| Platform | Unique Advantage | Best Fit |

|---|---|---|

| Koinly | DeFi support | Advanced traders |

| CoinTracker | Portfolio tracking | Long-term holders |

“Automated imports reduce errors by 72% compared to manual entry.”

Traditional Reporting Approaches

Manual methods remain viable for simple portfolios. Essential steps involve:

- Downloading CSV templates from exchanges

- Matching buys/sells chronologically

- Adjusting for network fees in calculations

Privacy coins like Monero require extra documentation. The IRS expects identifiable form submissions even for anonymized transactions.

Both methods demand reconciliation with 1099 forms. Proper crypto tax reporting protects against audits while maximizing legal deductions.

IRS Enforcement and Compliance

The IRS has significantly increased oversight of digital asset transactions in recent years. Advanced tracking methods and strict penalties ensure taxpayers properly report crypto activities. Understanding enforcement mechanisms helps avoid costly mistakes.

Tracking Methods for Digital Assets

Federal agencies employ sophisticated tools to monitor blockchain activity. Key enforcement strategies include:

- John Doe summonses to major exchanges like Coinbase and Kraken

- Chainalysis forensic software analyzing wallet patterns

- Automated matching of Form 1099 filings with tax return disclosures

“The IRS Criminal Investigation unit has seized over $10 billion in crypto since 2019.”

Consequences of Non-Compliance

Failing to properly disclose digital asset transactions triggers severe penalties. The IRS distinguishes between unintentional errors and willful neglect:

| Violation Type | Civil Penalty | Criminal Charge |

|---|---|---|

| Late filing | 5% monthly (max 25%) | N/A |

| Substantial understatement | 20% of underpayment | N/A |

| Fraudulent reporting | 75% accuracy penalty | Tax evasion (felony) |

The statute of limitations extends to six years for significant omissions. The voluntary disclosure program offers reduced penalties for amended filings.

Proper documentation protects against enforcement actions. Maintain transaction records for at least seven years to substantiate tax return positions.

Tax-Free Crypto Transactions

Strategic planning can unlock tax-free opportunities with digital assets. The IRS permits several methods to legally minimize or eliminate liabilities. Proper structuring turns complex regulations into financial advantages.

Maximizing Tax-Deferred Accounts

Retirement accounts provide exceptional crypto benefits. Contributions grow without immediate capital gains concerns. Key options include:

- 401(k) crypto funds: Select employer plans now offer direct digital asset exposure

- Roth IRAs: Qualified distributions remain completely tax-free after age 59½

- SEP IRAs: Self-employed miners can deduct equipment costs against income

Leveraging Long-Term Capital Rates

Assets held over 12 months qualify for reduced rates. The 2024 brackets offer significant savings:

| Filing Status | 0% Rate Threshold | 15% Rate Threshold |

|---|---|---|

| Single | Up to $47,025 | $47,026-$518,900 |

| Married | Up to $94,050 | $94,051-$583,750 |

Estate planning enhances these benefits. Gifting appreciated crypto resets cost basis for heirs. HSAs allow long-term capital growth when invested in digital assets.

“Taxpayers in the 10-12% brackets pay 0% on long-term capital gains.”

Annual harvesting of $3,000 in losses offsets ordinary income. Combined with retirement accounts, these strategies create powerful tax-free wealth building opportunities.

Common Mistakes to Avoid

Many crypto investors unknowingly trigger IRS audits through simple reporting errors. Even small missteps can lead to penalties or lengthy compliance reviews. Awareness of these pitfalls helps maintain clean records and accurate filings.

Ignoring Small Transactions

Daily crypto purchases create taxable events many overlook. A $200 coffee purchase using Bitcoin requires reporting just like large trades. The IRS expects documentation for all disposals.

Microtransaction tracking solutions simplify compliance:

- Exchange reports often miss wallet-to-wallet transfers

- Automated tools flag sub-$100 transactions needing documentation

- Forked assets require basis tracking regardless of value

“Taxpayers must report all virtual currency transactions, including small purchases.”

Misreporting Cost Basis

Incorrect basis calculations distort capital gains figures. Common errors include:

- Using LIFO when exchanges default to FIFO

- Forgetting to adjust for network fees

- Miscounting airdrop valuations

Foreign exchange rates complicate matters further. The IRS requires USD conversions at transaction time. NFT sales demand special attention too – minting costs establish basis, not secondary market prices.

| Mistake | Correction Method | Form Impact |

|---|---|---|

| Lost wallet reporting | Document attempted recovery | Form 8949 adjustment |

| Incorrect holding period | Verify blockchain timestamps | Schedule D reclassification |

Proper cost basis tracking prevents overstated gains. Maintain detailed information for all acquisitions and disposals. These records prove invaluable during audits or amended filings.

Tools and Resources for Crypto Taxes

The 2026 1099-DA requirement highlights the IRS’s focus on digital asset transparency. As regulations evolve, leveraging specialized tools and updated information ensures compliant filings. This section covers essential software and regulatory updates.

Best Crypto Tax Software

Leading platforms automate transaction tracking and tax forms generation. Key differentiators include DeFi support and audit trails. Below compares top solutions:

| Feature | ZenLedger | TokenTax |

|---|---|---|

| Exchange integrations | 400+ | 300+ |

| Tax-loss harvesting | Yes | Premium feature |

| IRS audit defense | Included | $250 add-on |

“Software reducing manual errors by 81% sees higher IRS acceptance rates.”

IRS Guidelines and Updates

Publication 544 details asset sales reporting, including NFTs. The 2026 1099-DA mandates broker reporting for all transactions. Compliance priorities:

- State tax rules vary (e.g., Texas exempts crypto-to-crypto trades)

- FBAR filings required for foreign accounts exceeding $10,000

- IRS news releases provide real-time advice on hard forks

International holders must reconcile FATCA requirements with local laws. Tools like CoinTracker now auto-flag cross-border reporting needs.

Seeking Professional Help

Complex crypto activities often demand specialized tax expertise. While software handles routine transactions, unique situations require human judgment. A qualified tax professional can navigate gray areas in regulations.

When to Consult a Tax Professional

Certain scenarios justify expert guidance. Mining operations with significant equipment costs need cost segregation studies. DeFi yield farming creates complex income streams that challenge automated tools.

Cross-border transactions introduce international reporting requirements. The IRS requires FBAR filings for foreign accounts exceeding $10,000. Professionals help determine if Form 8938 applies for larger holdings.

“CPA credentials don’t guarantee crypto expertise – ask about specific digital asset experience.”

Questions to Ask Your Tax Advisor

Not all professionals offer equal advice quality. Compare services using these criteria:

| Service Type | Best For | Limitations |

|---|---|---|

| CPA Firms | Business entities | May lack crypto specialization |

| Enrolled Agents | IRS audit defense | Limited state law knowledge |

| Crypto Tax Attorneys | Complex litigation | Higher hourly rates |

Quarterly estimated payments require precise calculations. Ask about penalty avoidance strategies. Verify their knowledge of recent tax court decisions affecting digital assets.

Conclusion

The evolving crypto taxes landscape demands proactive planning and reliable tools. Mark April 15 deadlines and consider quarterly estimates for active traders. Annual strategy reviews adapt to new IRS guidance like the 2026 1099-DA rules.

Emerging trends include state-specific regulations and DeFi reporting tools. TurboTax professional services guarantee accurate filings for complex portfolios. Their Full Service option provides audit support for digital assets.

Use this compliance checklist:

- Verify all tax return disclosures match exchange 1099s

- Document basis calculations for airdrops and NFTs

- Retain records for seven years

Automated platforms simplify tracking across wallets. This guide provides foundations, but consult experts for unique situations. Stay informed as regulations evolve.

FAQ

Why is cryptocurrency taxable?

The IRS treats cryptocurrency as property, not currency. This means transactions involving crypto are subject to capital gains tax rules, similar to stocks or real estate.

What forms are needed to report crypto transactions?

Key forms include Form 1040 (for general income), Schedule D (capital gains and losses), and Form 8949 (detailed transaction reporting). Income from mining or staking may require Form 1099-MISC or 1099-NEC.

How are capital gains calculated on crypto?

Subtract the cost basis (purchase price + fees) from the sale price. Short-term gains (held under a year) are taxed as ordinary income, while long-term gains (held over a year) have lower rates.

Do I need to report crypto if I didn’t sell?

Yes, if you received crypto as income (mining, staking, or payment) or traded one asset for another. Simply holding isn’t taxable, but exchanges trigger a taxable event.

What happens if I don’t report crypto taxes?

The IRS imposes penalties for underreporting, including fines and interest. In severe cases, non-compliance may lead to audits or legal action.

Are crypto-to-crypto trades taxable?

Yes. Trading Bitcoin for Ethereum, for example, is treated as selling one asset to buy another. You must report gains or losses based on the fair market value at the time of the trade.

How can I simplify crypto tax reporting?

Use crypto tax software like CoinTracker or Koinly to automate transaction tracking and generate IRS-compliant reports. These tools sync with exchanges to calculate gains/losses accurately.

Are airdrops and hard forks taxable?

Yes. Airdrops are considered ordinary income at their fair market value when received. Hard forks creating new coins (e.g., Bitcoin Cash) follow similar rules if you gain control of the new asset.

Can I deduct crypto losses?

Yes. Capital losses offset gains and up to ,000 of ordinary income yearly. Excess losses carry forward to future tax returns.

When should I hire a tax professional?

Consult a tax advisor if you have complex transactions, high-volume trading, or uncertainty about reporting. They can help navigate IRS rules and minimize liabilities.