Table of Contents

The value of 100 Bitcoins in USD is a significant figure that attracts investors and cryptocurrency enthusiasts alike. As of the latest update, 100 Bitcoins is worth approximately $10,771,400 USD according to one source, and $10,803,336 USD according to another.

This comprehensive guide will explore the real-time exchange rates between BTC and USD, providing insights into the current price and value of this substantial cryptocurrency holding. Understanding the dynamics of the crypto market is crucial for investors and traders.

We’ll delve into the aspects that influence the valuation of 100 BTC, including historical context and conversion mechanisms, to give you a thorough understanding of its worth in USD terms.

Current Value of 100 Bitcoins in USD

As the cryptocurrency market continues to evolve, knowing the current value of 100 Bitcoins in USD is more important than ever. Based on the latest data, 100 BTC equals approximately $10,771,400 USD. This valuation is subject to market fluctuations and can change rapidly due to Bitcoin’s volatility.

Real-Time Exchange Rate

The exchange rate for Bitcoin to USD is constantly changing. To get the most accurate and up-to-date exchange rate, it’s best to use a reliable bitcoin to USD converter.

Factors Affecting Today’s BTC Value

Several factors influence the current valuation of Bitcoin, including:

- Multiple factors influence Bitcoin’s current valuation, including market sentiment, institutional adoption, and macroeconomic trends.

- Regulatory developments from major economies can cause significant price movements in the BTC/USD exchange rate.

- Technical factors such as mining difficulty, network hash rate, and upcoming protocol upgrades affect investor confidence and price.

- Market liquidity and trading volume across major exchanges contribute to price stability or volatility.

- Global economic conditions, including inflation rates and monetary policy decisions, increasingly impact Bitcoin’s value as it gains mainstream recognition.

How Much is 100 Bitcoins Worth in Different USD Amounts

Understanding the value of 100 Bitcoins in USD is crucial for investors looking to diversify their portfolios. The conversion of Bitcoin (BTC) to USD is not straightforward due to the cryptocurrency’s volatile nature.

According to the conversion table, 100 BTC equals $10,771,400 USD. To put this into perspective, let’s break down the value further.

Breaking Down the Value

The value of 100 BTC can be understood by comparing it to other common BTC holdings. For instance, 1 BTC is equivalent to $107,714 USD, and 10 BTC equals $1,077,140 USD.

- Common investment amounts range from 0.1 BTC (approximately $10,771 USD) to 10 BTC (approximately $1,077,140 USD).

- Institutional investors often hold larger amounts, with 100 BTC representing a substantial portfolio.

Comparing to Other Common BTC Holdings

Comparing different BTC holdings provides context for understanding the value of 100 BTC. Other notable conversions include 250 BTC = $26,928,500 USD and 500 BTC = $53,857,000 USD.

- These comparative values help investors benchmark their holdings against market averages.

- Professional traders use these values to establish position sizes and risk management parameters.

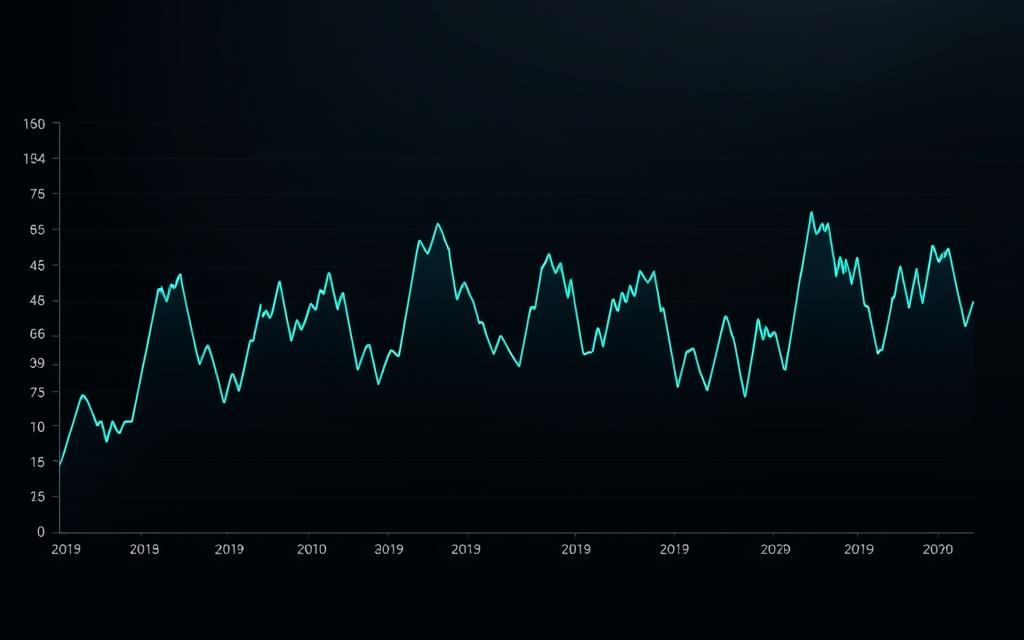

Historical Context: 100 BTC Value Fluctuations

As Bitcoin continues to mature as an asset, examining its historical price fluctuations offers a unique perspective on its current value. The cryptocurrency has experienced significant volatility throughout its history.

The value of 100 BTC has ranged from a few hundred dollars in its early days to over $6 million during the 2021 bull run, and now stands at approximately $10.8 million. For more information on Bitcoin’s price history, visit Bankrate’s Bitcoin price history page.

Recent Price Movements

Recent price movements in the Bitcoin market have been characterized by significant fluctuations. Some key factors influencing these movements include:

- Market sentiment and investor confidence

- Regulatory changes and government policies

- Technological advancements and adoption rates

Volatility Analysis

Analyzing the volatility of Bitcoin’s price is crucial for understanding its behavior as a currency. Key points to consider include:

- Bitcoin’s price volatility remains significantly higher than traditional asset classes.

- Statistical measures show a gradual maturation of the BTC/USD market over time.

- Risk management strategies must account for this inherent volatility.

Converting Between Bitcoin and USD

For those looking to cash out their Bitcoin holdings, understanding the conversion process to USD is crucial. The most common method of converting BTC to USD is through a crypto exchange or a P2P (person-to-person) exchange platform.

Popular Conversion Methods

Popular conversion methods include using well-established exchange platforms that offer competitive rates and robust security measures. These platforms facilitate trading between various cryptocurrencies and fiat currencies like USD.

Exchange Fees and Considerations

When converting BTC to USD, it’s essential to consider the fees associated with the transaction. Exchange fees for BTC/USD conversions typically include trading fees (0.1-0.5%), withdrawal fees, and potential spread markups. For large transactions, such as converting 100 BTC, these fees can be significant, potentially amounting to thousands of dollars.

- Market depth affects the effective exchange rate for large BTC amounts.

- Regulatory compliance, including KYC/AML procedures, is crucial for high-value conversions.

- Tax implications must be considered, as converting BTC to USD is typically a taxable event.

Understanding the Value of Your Bitcoin Investment

To grasp the value of your Bitcoin holdings, it’s essential to look beyond the current exchange rate. The BTC/USD relationship is influenced by global economic factors, making it crucial to monitor world financial markets when valuing cryptocurrency investments.

Professional investors evaluate Bitcoin as an asset class within a broader portfolio context. They consider factors such as correlation with other assets and overall risk profile. For a comprehensive understanding, it’s vital to consider multiple factors beyond the current exchange rate, including market analysis tools and regulatory developments.

For more information on Bitcoin, you can visit Wikipedia’s Bitcoin page. By understanding the technical aspects of Bitcoin’s scarcity, security model, and network effects, investors can gain deeper insights into its long-term value proposition.

FAQ

What is the current exchange rate for Bitcoin to USD?

The current exchange rate for Bitcoin to USD can be found on reputable cryptocurrency exchanges such as Coinbase or Binance, which provide real-time data on the BTC to USD conversion rate.

How do I convert 100 Bitcoins to USD?

To convert 100 Bitcoins to USD, you can use a cryptocurrency exchange or a conversion calculator that provides the current exchange rate, taking into account the market value of Bitcoin and any applicable fees.

What factors affect the value of Bitcoin in USD?

The value of Bitcoin in USD is affected by various factors, including market demand, supply, and global economic conditions, as well as the overall sentiment of investors and traders in the cryptocurrency market.

Can I check the historical value of 100 Bitcoins in USD?

Yes, you can check the historical value of 100 Bitcoins in USD using online tools and charts that track the price movements of Bitcoin over time, providing insights into its past performance.

What are the fees associated with exchanging Bitcoin for USD?

The fees associated with exchanging Bitcoin for USD vary depending on the exchange or platform used, with some charging a flat fee and others charging a percentage of the transaction amount, so it’s essential to review the fee structure before making a transaction.

How can I stay up-to-date with the current Bitcoin price in USD?

You can stay up-to-date with the current Bitcoin price in USD by following reputable cryptocurrency news sources, setting up price alerts on exchanges or tracking platforms, or using a cryptocurrency price ticker on your website or mobile device.