Table of Contents

Digital assets require personal responsibility for protection. Unlike traditional banking, transactions in blockchain networks are irreversible. Once funds move, recovery becomes nearly impossible.

Recent data reveals alarming trends. In 2024 alone, thieves stole $494 million through wallet attacks—a 67% increase from previous years. High-value accounts face particular risk, making robust protection essential.

The foundational principle remains clear: “Your keys, your responsibility.” This philosophy separates cryptocurrency from conventional finance. Users control access through private keys rather than relying on third parties.

Security strategies vary by need. Bitcoin.org recommends balancing convenience and safety. Keep small amounts in accessible wallets for daily use while storing larger amounts offline. Hardware solutions offer optimal protection for savings.

Effective protection involves multiple layers. Encryption, backups, and specialized devices create barriers against threats. Strong passwords and multi-signature setups add further safeguards.

Understanding Crypto Wallet Security

Blockchain technology offers financial freedom but demands vigilant protection. Without centralized oversight, users bear full responsibility for safeguarding their private keys and assets. A single mistake can lead to irreversible losses.

Why Wallet Security Matters

The 2022 Ronin Network breach lost $622 million in user funds. Unlike credit cards, blockchain transactions cannot be reversed. Once private keys are compromised, recovery is impossible.

Hot wallets, like BitMart’s, are frequent targets. In 2021, hackers drained $200 million from its servers. This highlights the risks of storing large sums online.

Common Threats to Crypto Wallets

Phishing scams trick users into revealing keys. Fake MetaMask support pages and Ledger data leaks (270K users in 2020) exploit trust. Always verify URLs and avoid unsolicited messages.

Technical attacks include:

- Keyloggers recording keystrokes

- Clipboard hijackers altering wallet addresses during pastes

- DeFi protocol exploits draining connected wallets

Over 300,000 wallets were compromised in 2024 alone. Multi-vector attacks combine these methods for maximum damage.

Custodial services (e.g., Coinbase) manage keys but risk exchange breaches. Non-custodial wallets (e.g., Exodus) grant full control but require stricter self-protection. Choose based on your risk tolerance.

How to Secure My Crypto Wallet: Essential Steps

Robust protection requires a blend of hardware, software, and vigilance. Each layer adds critical barriers against threats. Below are three non-negotiable practices to safeguard assets.

Selecting the Right Wallet Type

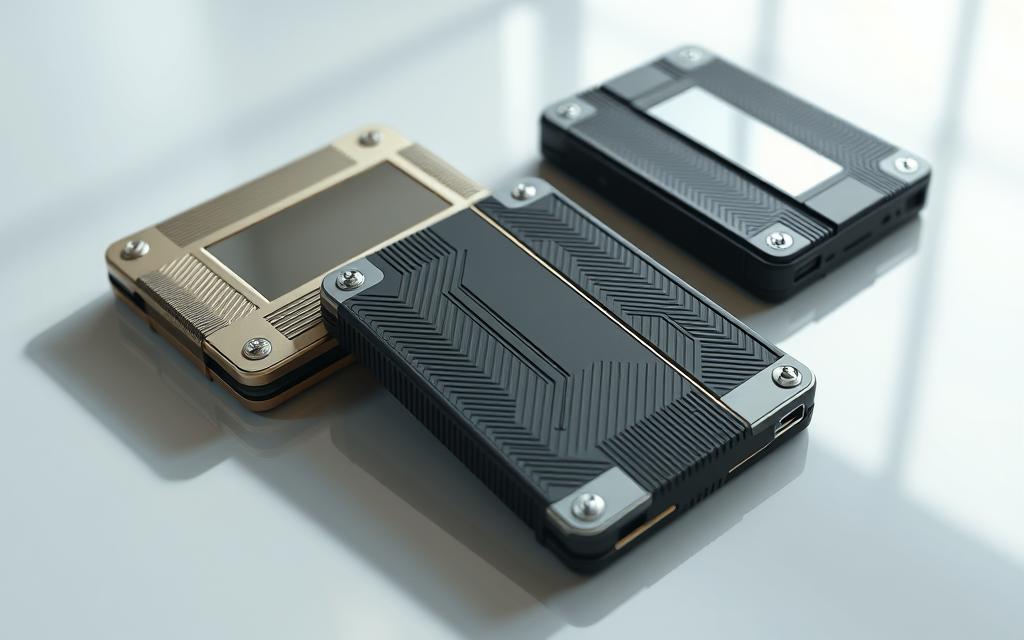

Hardware wallets like Trezor and Ledger offer offline storage, isolating keys from online threats. Software wallets (e.g., MetaMask) provide convenience but risk exposure to malware.

| Feature | Trezor Model T | Ledger Nano X |

|---|---|---|

| Price | $219 | $149 |

| Connectivity | USB-C | Bluetooth + USB |

| Supported Assets | 1,800+ | 5,500+ |

Enabling Two-Factor Authentication

Two-factor authentication (2FA) adds a second verification step. Apps like Google Authenticator generate time-sensitive codes. Avoid SMS-based 2FA—SIM-swap attacks bypass it easily.

“SMS authentication is the weakest link in 2FA. Use app-based codes instead.”

Creating Strong Passwords

A strong password follows this formula:

- 12+ characters with symbols (e.g., 7$Tiger#Moon!9)

- No reuse across accounts

- Stored in a password manager

Pair these steps with regular audits for airtight security.

Encrypting Your Wallet for Maximum Protection

Encryption transforms vulnerable data into an unreadable fortress. Modern wallets use AES-256, the same standard governments trust for classified data. This scrambles your keys into ciphertext, blocking unauthorized access.

Wallet Encryption Basics

Software like Electrum lets you manually encrypt wallet.dat files. Enable this feature during setup or via settings. Always verify encryption status before transferring funds.

Avoid cloud backups of unencrypted keys. Google Drive or iCloud breaches have exposed millions. Instead, use BIP38 for paper wallets—it adds a password layer to printed keys.

Password Management Best Practices

Strong passwords require:

- 12+ characters with symbols (e.g., J4#f9!qL$vP7)

- No reuse across accounts

- Storage in dedicated managers (see comparison below)

| Feature | LastPass | KeePass |

|---|---|---|

| Encryption | AES-256 | AES-256 |

| Access | Cloud-based | Local storage |

| Auto-fill | Yes | Manual only |

“Browser-stored passwords are low-hanging fruit for malware. Use standalone managers for critical accounts.”

Rotate passwords every 90 days. Set reminders to update wallet and manager credentials. Never share them—even with “support” teams.

Backup Strategies to Prevent Loss

Losing access to digital assets often happens without warning. A 2023 Chainalysis report showed 23% of lost funds resulted from poor backup practices. Proper planning ensures recovery from device failures, theft, or natural disasters.

Creating and Storing Seed Phrases

The BIP39 standard uses 12-24 word seed phrases to restore wallets. Never store these digitally—iCloud breaches have exposed photographed phrases. Instead:

- Etch phrases into stainless steel plates (Cryptosteel survives 1,500°F)

- Split phrases across multiple locations using Shamir’s Secret Sharing

- Billfodl offers waterproof titanium alternatives

Regular Backup Schedules

Active wallets need weekly backup updates, while cold storage requires quarterly checks. Casa’s 3-of-5 multi-signature model demonstrates redundancy—losing one device won’t lock funds.

Offline Backup Options

Follow the 3-2-1 rule for offline protection:

- 3 copies total

- 2 different media types (metal + paper)

- 1 geographic separation (home + safety deposit box)

“Test recovery annually—a backup is only good if it works.”

Remember: Never email or cloud-store unencrypted phrases. A single breach could drain your entire address balance permanently.

Advanced Security Measures

Sophisticated threats demand equally advanced countermeasures. For high-value funds, standard protections often fall short. Enterprise and individual users alike benefit from layered, specialized solutions.

Hardware Wallets: The Gold Standard

Hardware wallets like Ledger Stax and Trezor Safe 3 isolate private keys offline. Their tamper-proof chips block malware attacks, making them ideal for long-term savings.

Key differences:

- Ledger Stax: Touchscreen + Bluetooth ($279)

- Trezor Safe 3: USB-only, open-source firmware ($149)

Air-gapped devices like Coldcard Mk4 take this further. They never connect to the internet, requiring manual transaction signing via SD cards.

Multi-Signature Wallets for Extra Security

Multi-signature setups require approvals from multiple devices or parties. Casa’s 3-of-5 model splits control across:

- Your hardware wallet

- Two trusted devices

- Two backup keys

Businesses use Unchained Capital for collaborative custody. Transactions need 2-of-3 signatures from executives, reducing insider fraud risks.

Offline (Cold Storage) Solutions

Cold storage methods vary by cost and complexity:

| Method | Cost | Best For |

|---|---|---|

| Glacier Protocol | $200+ | Technical users |

| Coinbase Vault | 0.1% fee | Beginners |

“Self-managed cold storage offers sovereignty; custodial options trade control for convenience.”

Electrum’s offline mode lets you sign transactions on an air-gapped computer. This adds a critical layer for large transfers.

Avoiding Common Security Pitfalls

Protecting digital assets requires awareness of common traps. Over 60% of thefts stem from preventable errors rather than advanced hacks. Recognizing these dangers is the first step toward stronger defenses.

Phishing and Social Engineering Attacks

Phishing scams often mimic legitimate services. A 2023 MyEtherWallet analysis found 412 fake domains like “myetherwallet[.]org” stealing credentials. Always verify URLs before entering keys.

Watch for these red flags:

- Urgent support requests via email or SMS

- Misspelled website names (e.g., “ledgervvallets.com”)

- Fake browser extensions with slight name variations

Risks of Public Wi-Fi and Unsecured Networks

Public Wi-Fi networks expose traffic to snoopers. NordLayer tests show hackers intercept 78% of unencrypted data in coffee shops. For safer browsing:

- Use ExpressVPN or similar services

- Enable “Always-On VPN” in settings

- Verify VPN connection before accessing wallets

Fake Wallet Apps and Scams

App stores host counterfeit wallets stealing funds. Compare these markers of authentic apps:

| Feature | Real App | Fake App |

|---|---|---|

| Developer | Verified company (e.g., “Ledger SAS”) | Generic name (e.g., “Crypto Tools LLC”) |

| Downloads | 100,000+ | |

| Permissions | Minimal access | Requests SMS/contacts |

“Assume every download is malicious until proven otherwise. Check GitHub repositories and audit reports.”

When buying hardware wallets:

- Purchase directly from manufacturer websites

- Avoid third-party sellers on Amazon/eBay

- Verify tamper-proof seals upon delivery

Conclusion

Managing digital assets safely demands constant vigilance. Unlike traditional banking, blockchain offers no recourse for stolen funds. The 2024 surge in thefts—$494 million lost—proves threats evolve rapidly.

Prioritize three pillars: cold storage for savings, multi-signature setups for shared control, and verified software for daily use. Education remains critical—attackers refine tactics monthly.

Plan for emergencies. Services like Casa Covenant help designate inheritors without exposing keys. Start today:

- Audit wallet permissions quarterly

- Bookmark security resources (Trail of Bits reports)

- Test recovery procedures annually

Remember: Your vigilance defines your safety in this decentralized environment. Stay informed, stay protected.

FAQ

What is the safest type of wallet for storing digital assets?

A: Hardware wallets like Ledger or Trezor provide the highest security by keeping private keys offline. These devices protect against malware and unauthorized access, making them ideal for long-term storage.

How does two-factor authentication (2FA) improve wallet security?

2FA adds an extra layer of protection by requiring a second verification step, such as a code from an app like Google Authenticator. This prevents unauthorized access even if your password is compromised.

What makes a strong password for a crypto wallet?

A robust password includes uppercase letters, numbers, and special characters, with at least 12 characters. Avoid common phrases or personal details. Password managers like Bitwarden can generate and store complex passwords securely.

Why should I avoid keeping funds on exchanges?

Exchanges are prime targets for hackers. Unlike personal wallets, you don’t control the private keys, leaving assets vulnerable. Transfer funds to a secure wallet unless actively trading.

How do I recognize a phishing scam targeting my wallet?

Scammers often mimic legitimate platforms via fake emails or websites. Always verify URLs, avoid clicking suspicious links, and never share seed phrases or passwords. Bookmark official wallet sites for safe access.

What’s the best way to back up a wallet?

Write down the seed phrase on paper and store it in multiple secure locations, like a safe or safety deposit box. Avoid digital backups (e.g., screenshots) to prevent exposure to hackers.

Are software wallets safe for everyday transactions?

Reputable software wallets like Exodus or Trust Wallet with encryption and 2FA are convenient for small amounts. For larger holdings, combine them with hardware wallets or cold storage for added security.

Can public Wi-Fi compromise my wallet?

Yes—unsecured networks expose data to interception. Use a VPN or mobile data when accessing wallets remotely, and disable auto-connect features to prevent unintentional exposure.